With a view to financing the transformation to a sustainable economy, Sustainable Finance should help to redirect financial flows to a sustainable economy more effectively than before. Securitisations should and can make a contribution to channelling financial resources into the transformation more quickly and in line with actual needs. The key to this lies in creating market transparency in ESG information and ensuring market integrity by avoiding greenwashing.

Required ESG information comprises investment products and securities, including securitisations, and a look through to individual economic activities of companies. Standardisation of ESG information across Europe requires a consistent methodology for producing reliable and comparable ESG data points. Especially in the context of securitisation, Sustainable Finance does not yet provide a uniform framework for reporting and disclosure requirements.

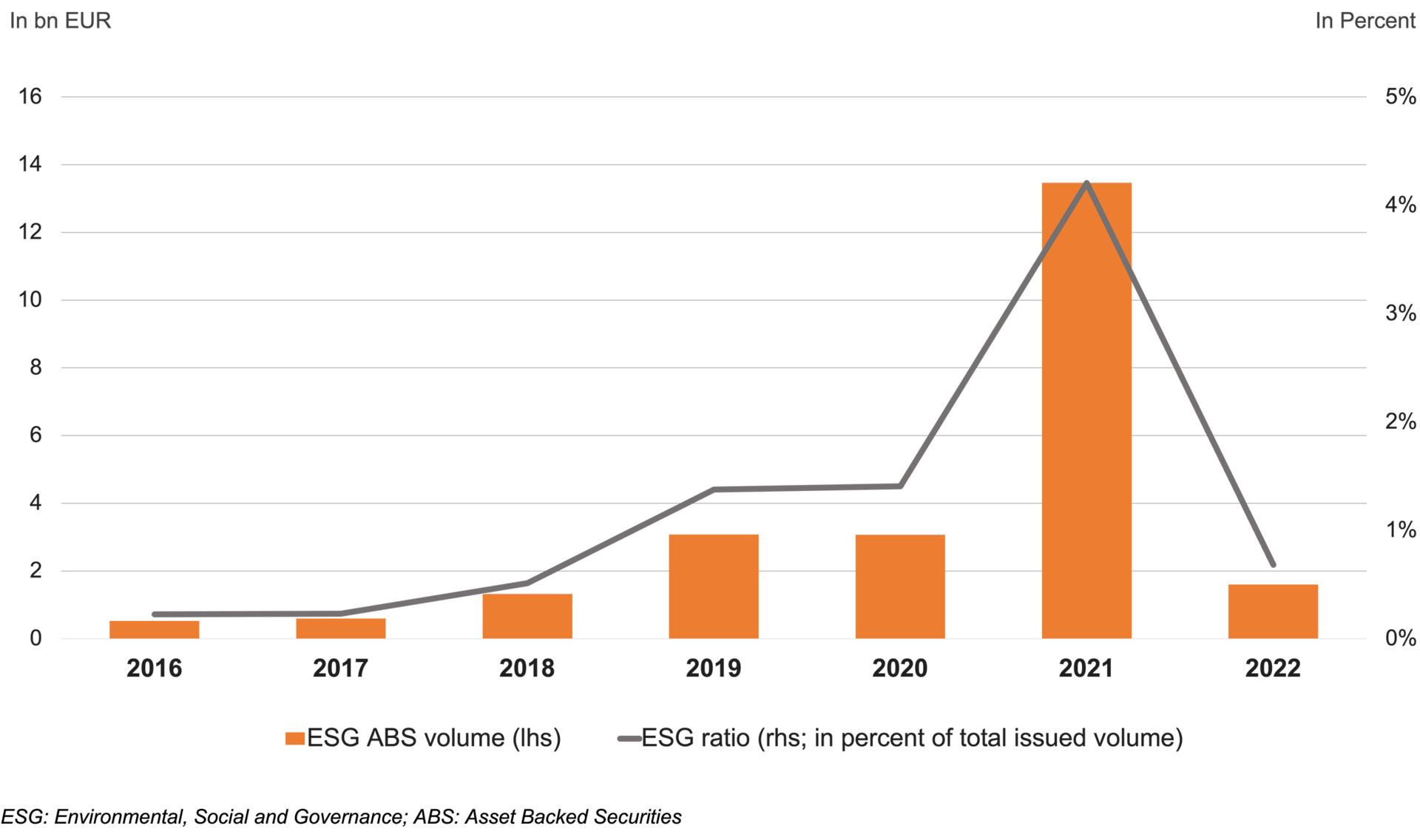

In parallel to the legislative processes in the context of Sustainable Finance (see II. Regulation), which started for securitisations primarily in the second half of 2021, there was a significant decrease in public ABS transactions with an ESG label. In recent years, sustainability-oriented securitisations have generally accounted for a very small share of the market volume of all public ABS transactions.

Other causes of this market development include

- a general decline in the market for CLO transactions, which previously made up a large part of the green securitisation market,

- a growing awareness of greenwashing risk (reputational risk) and

- limited growth potential for green mortgages and electric vehicles (household income/affordability) in the relevant markets.