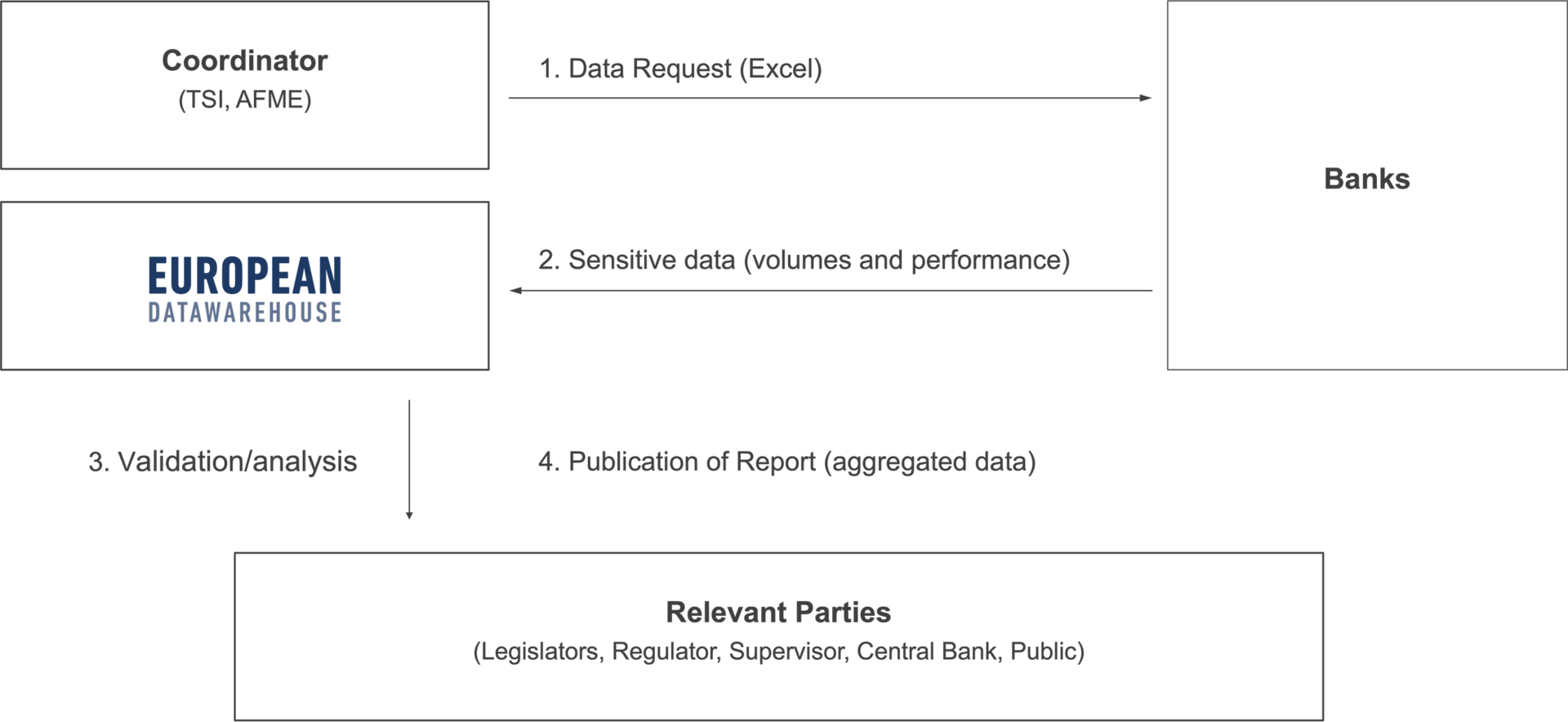

The European Benchmark Exercise (EBE) is a market-based initiative launched in 2021 by AFME, the European DataWarehouse and TSI. The objective is to significantly increase the market transparency of ABCP and other private securitisations in the EU and the UK. The results are made available to supervisory bodies, policymakers and interested members of the public. Synthetic balance sheet securitisations and public ABS are not considered.

- The total ABCP/private market in Europe and the UK is estimated at €196 billion in financing commitments for the real economy and sales financiers

- Trade receivables and auto loans or leases account for about 73% of the market

- EU originators account for over 72% of the volume

- Over 72% of the funds generated by ABCPs and private securitisations directly finance real sectors of the economy

- Originators rated BBB or below at the start of the transaction account for approximately 87% of the volume

- In contrast, the average transaction rating is in the A to AA range

The results show that the ABCP/private market is an important instrument for financing working capital and sales, especially for originators with lower ratings.

Longer time series for ABCP and private securitisations are not yet available under the EBE. However, based on the level of transparency now established with regard to asset classes, countries and the credit ratings of originators and securitisations, we can already see that ABCP and private securitisations are also performing very well and that the financing banks do not generally suffer payment defaults in this business segment.

For more information go to: EBE Report of 20 September 2023.