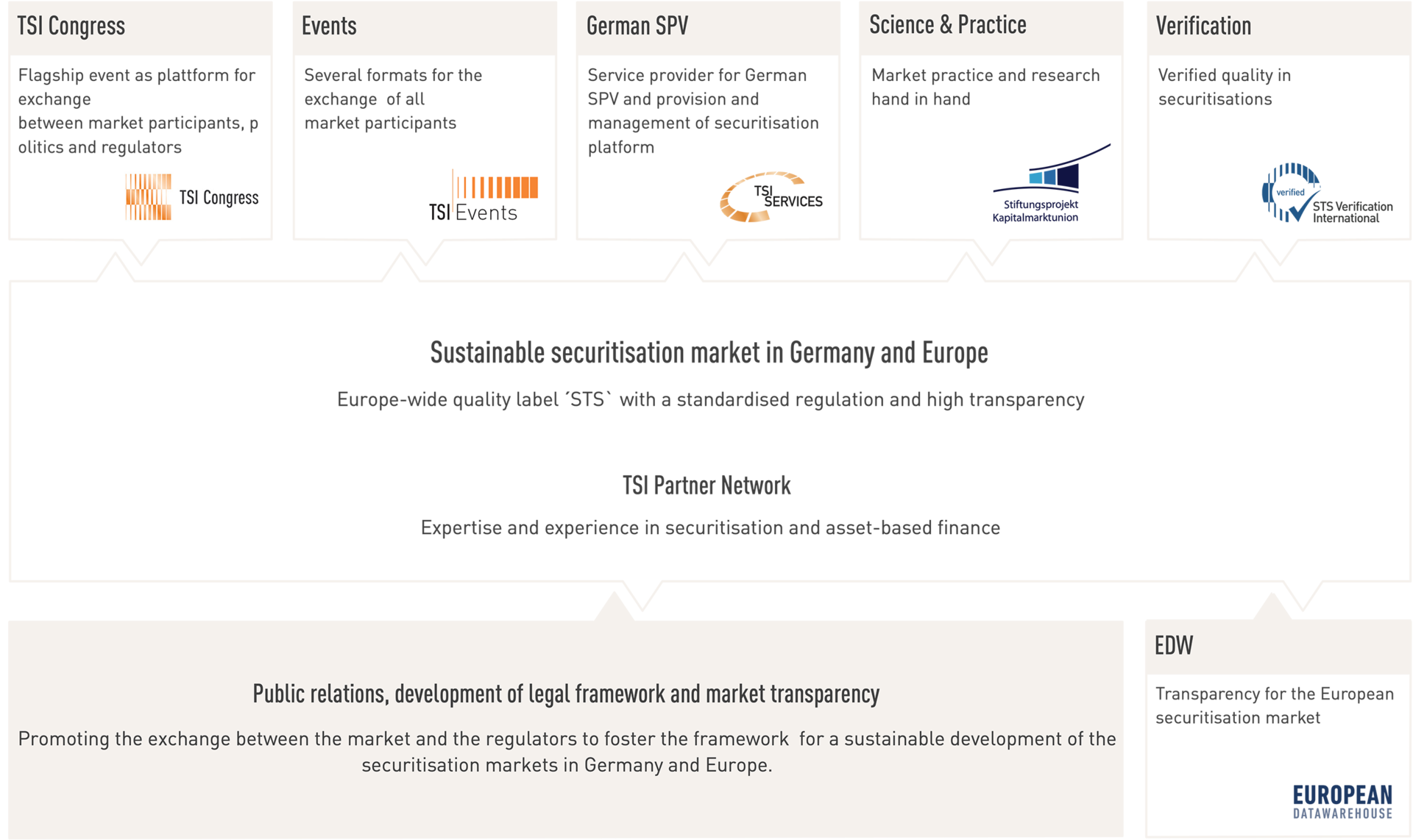

Quality Standard Certification & Verification

Since our foundation, TSI has stood for quality in German securitisation transactions.

With TSI certification, we have had our own quality label in the market since 2005.

CERTIFIED BY TSI - DEUTSCHER VERBRIEFUNGSSTANDARD

Since 2019, we have consistently continued to implement quality standards in the German and European securitisation market with STS Verification, which is provided by our subsidiary SVI.

STS Verification International (SVI)

SVI's mission is to contribute to a well-developed, high-quality and sustainable securitisation market in Europe by conducting a neutral and objective verification of the STS criteria for securitisation transactions.

German SPV

With the German securitisation platform, at TSI we have been providing our clients with an infrastructure for covered financing with German special purpose vehicles (SPVs) via our subsidiary TSI Services since 2004. In more than 160 transactions (as of April 2023), domestic and foreign originators have already used a German SPV for their securitisation transaction.

Events

Quality also plays a central role for TSI events. The diverse training and event programme, which reaches well over 1,000 participants from all market sectors every year, covers all important topics. From training formats to workshops and conferences to the annual TSI Congress in Berlin, the event formats with which TSI offers a platform for sharing knowledge and views on current developments in the securitisation market and beyond are extensive.

Science funding

Promoting science is also one of our tasks. This takes place in the form of support for the three non-profit foundations that belong to the securitisation platform. Through close cooperation between the Capital Markets Union Foundation Project and academia, we bridge the gap between practice and science. We also specifically promote the dialogue between academia and practice on issues of bank and capital market financing in Germany and Europe. Furthermore, we support academic research on key capital market topics through conferences, expert reports and targeted measures (scholarships, grants).

TSI Partners

In addition to our ten shareholder banks, we are now supported by a broad and high-calibre network of around 70 companies from the asset-based finance industry that reflects all stakeholders in the securitisation market. This TSI network occupies a central position at the heart of the German asset-based finance market. We are significantly supported in our tasks by this network of national and international banks and law firms, rating agencies, auditing firms and service providers.

Public relations work, securitisation, further development of legal framework and market transparency

Another task is to promote exchange between the market and regulators. This is done largely through supportive public relations work and further development of the legal framework for securitisation and contributes to further establishing securitisation as a stringently and uniformly regulated capital market product. A core objective is to position securitisation as an important financing instrument for the real economy.

Shareholder of the EDW

European DataWarehouse (EDW) is a securitisation repository supervised by the European Securities and Markets Authority (ESMA) and the Financial Conduct Authority (FCA). It was established in 2012 as the first securitisation repository in Europe to facilitate the collection, validation and download of standardised data at the individual loan level for asset-backed securities and private whole loan portfolios.

In 2019, the EDW became the first securitisation repository to be authorised by the ESMA under the EU Securitisation Regulation. As a market infrastructure, the EDW contributes significantly to increasing transparency and further strengthening confidence in the securitisation market.