Along with the introduction of the Securitisation Regulation, the CRR contents for securitisations have also been adjusted. On the one hand, all definitions relevant to securitisation have now been uniformly incorporated into the STS Regulation and, on the other hand, the rules for capital backing for the investor with securitisation exposures have been fundamentally revised and amended.

Capital weighting for banks

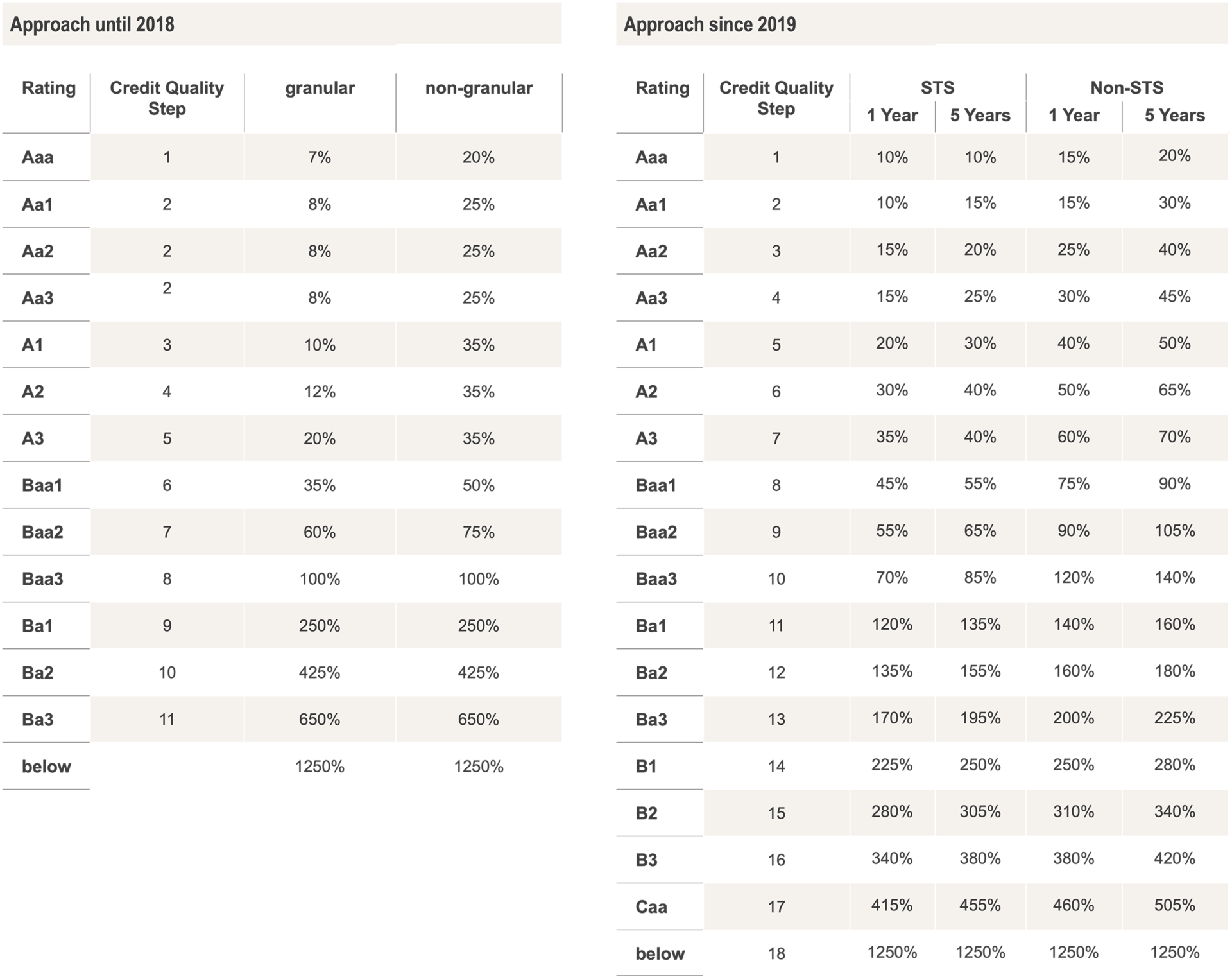

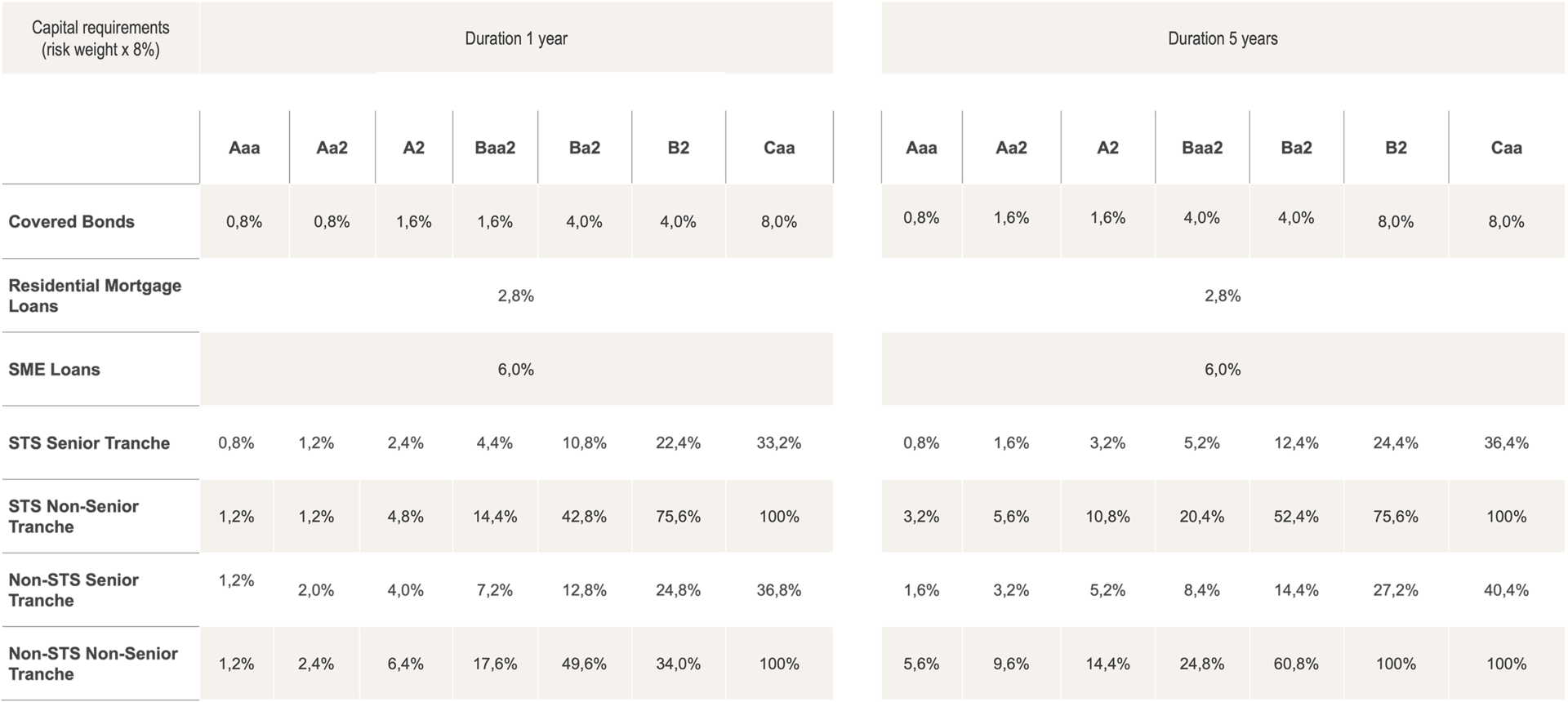

With the entry into force of the Securitisation Regulation, the capital weights for securitisation positions were significantly increased and a differentiation by maturity was introduced. The increase in risk weights is only mitigated if the STS criteria are met, as exemplified by the risk weights in the external ratings-based approach (SEC-ERBA).

It can be clearly seen that, in relative terms, the capital requirements for securitisations are not adequate, especially as the transparency requirements for securitisations are significantly higher than for other financial instruments (loan-by-loan data vs., for example, aggregated pool data for covered bonds). Furthermore, the due diligence requirements for securitisations are also the highest by comparison. The imbalance in capital requirements despite comparable or even lower risks puts securitisation at a disadvantage compared with other financial instruments in the market.

- Liquidity Coverage Ratio (LCR)

In July 2018, the Commission published a Delegated Act on the treatment of STS securitisations in the LCR. The possibility of considering STS securitisations and their inclusion in the LCR is in line with the objectives of the new Securitisation Regulation as formulated by the legislator. However, there were also critical comments from the market:- Consideration at Level 2B: STS as a premium segment rightly places extensive requirements on securitisations. However, their exclusive inclusion in LCR Level 2B does not dignify this approach.

- ABCP: With the same argument, the non-inclusion of fully-supported asset-backed commercial paper (ABCP) is not comprehensible.

- Leverage ratio

For retained ABS - i.e. the retention of all tranches as ECB collateral - the treatment in the leverage ratio is not clearly regulated. However, the view seems to prevail that, with reference to the regulations on COREP reporting, only assets backed by equity must be included in the calculation. Accordingly, retained tranches of own securitisations do not have to be taken into account.

- Net Stable Funding Ratio (NSFR)

Regulation (EU) 2019/876 (‘CRR II’) formulated the requirements for the NSFR in detail. Depending on the degree of liquidity and maturity, the balance sheet items are given weighting factors with which they are included in the calculation of the NSFR. The NSFR must be at least 100%. The following rules apply with regard to securitisation positions:- On the asset side (required stable funding), a credit institution may apply a factor of 25 % or 35 % for Level 2B-eligible (LCR) securitisations, depending on the type of securitised exposures. It should be noted that securitised exposures that remain on the originator's balance sheet are considered 'encumbered' for the purposes of CRR II and must be considered with a factor of 100%.

- Liabilities from securitisations should generally fulfil the requirements of a fixed and at least one-year residual maturity and can thus be considered with a factor of 100% for the available stable refinancing.

- Securitisations also generally fulfil the requirements of Art. 428f (1) CRR for interdependent positions, so they can be weighted with 0% in each case - after approval has been granted by the competent supervisory authority.