What is securitisation transactions?

Securitisation begins with the definition of objectives to be achieved, and this serves as the basis for identifying the portfolio to be securitised. A decision is made as to whether a sale under civil law (true sale) is to be made to an SPV. The SPV then finances the purchase via securities on the capital market or via one or more banks. Alternatively, a hedging agreement is concluded with one or more investors via a synthetic balance sheet securitisation, without a real sale taking place. In each case, the defining feature of the securitisation is the distribution of default risks across several tranches with different rankings. The interest and principal payments of the senior tranches are initially serviced from the incoming payments from the underlying receivables (underlyings) in the portfolio (waterfall principle). Another defining feature is that the repayment of the securities issued depends on the payments of the underlying receivables. The securitising company or bank is not directly liable for the repayment of the financing. Securitisation transactions are therefore also referred to as asset-backed securities (ABS).

Asset-Backed Securities (ABS)

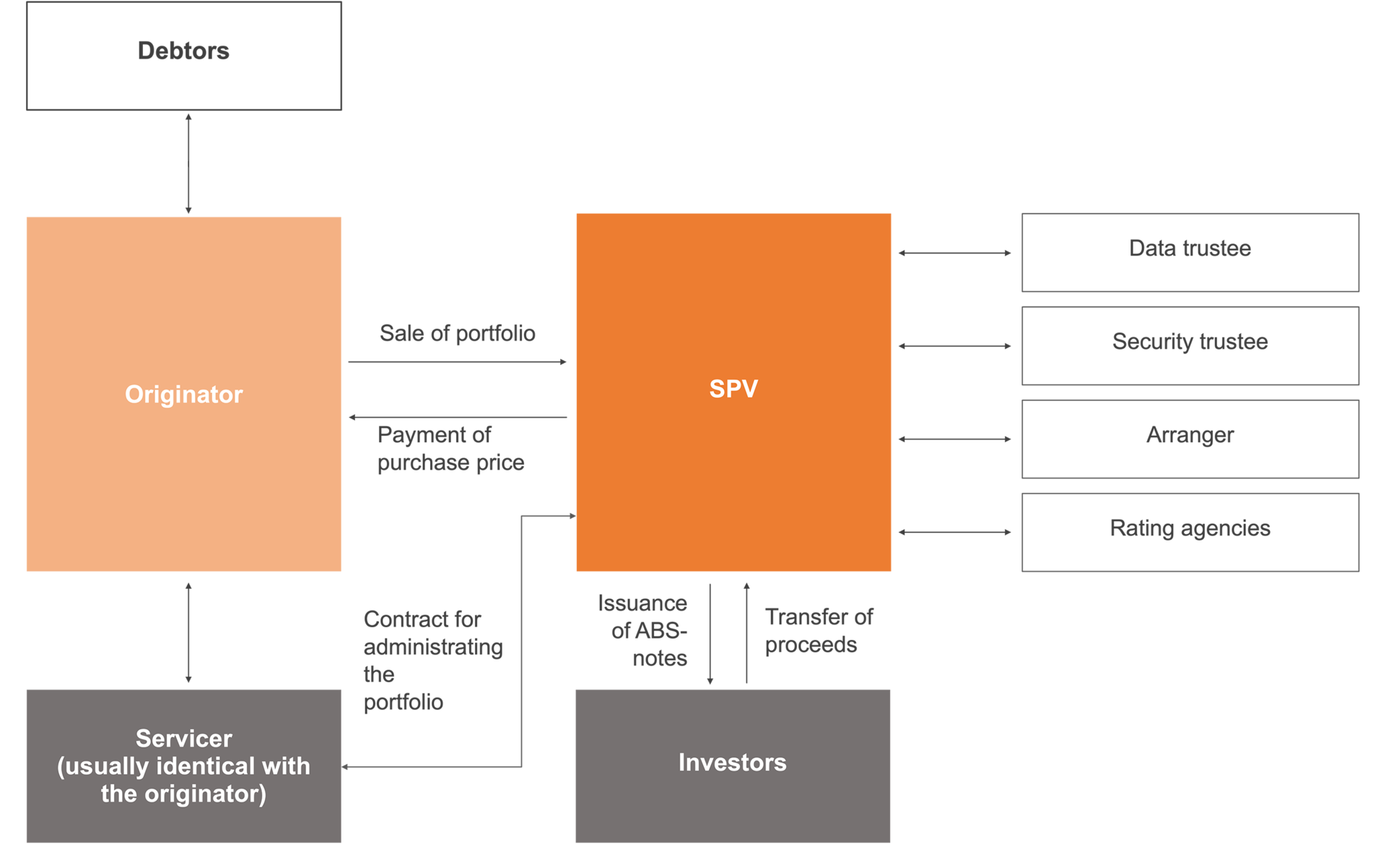

In classic asset-backed securities (ABS), the asset is based on a contractual debt relationship between a debtor (e.g. the borrower of a bank) and a creditor (in this case the bank financing the loan). As part of this ABS transaction, the bank acts as the seller of the receivable (originator). The sale of receivables is without recourse: in a securitisation transaction, the investor acquires no further claims against the seller of the receivables (originator) and thus bears the risk of repayments and interest payments from the underlying debt relationship. The receivable is generally transferred via a special purpose vehicle (SPV) between the originator and the investor.

SPV

The SPV ensures that the securitised receivables are legally separated from the originator (true sale). If the originator becomes insolvent, its other creditors have no access to the securitised receivables in the SPV. All future cash flows from these receivables are payable to the SPV. Even in the event of the originator's insolvency, the SPV services the investors' repayment and interest payment claims from the securitised receivables. In practice, the SPV is therefore also designed to be insolvency remote. Corresponding contractual arrangements prevent the SPV from engaging in other activities and/or taking on other business risks (limited recourse clauses).

From the investors' point of view, the securitised receivables serve as liability cover without restriction.

Credit Spreads

ABS are typically issued as variable-interest securities. Their interest premium (credit spread) in basis points above a reference interest rate (usually 1-month Euribor) reflects the default risk of the security and therefore the investor's return.

The spread width depends on the following factors:

- Rating

- Asset class

- Term

- Country of origin of the originator or the receivables

- Macroeconomic environment

A number of other factors (e.g. the originator's credit rating, STS and ECB eligibility) also affect the development of securitisation spreads.

Credit enhancements

A number of securitisation mechanisms or credit enhancements are designed to further reduce the credit rating or default risk of the issued security from the perspective of investors in the respective tranches. The most common credit enhancements are positive interest rate differentials between the interest received from the portfolio and the interest paid to investors (excess spread) and overcollateralisation, where the underlying portfolio is larger than the volume of securities issued. Tranching is another element of credit enhancement that is common in securitisation. This creates collateral for higher-ranking tranches through subordinated tranches. Risk can be further reduced by including insurance policies for incurred losses or guarantees. Investors may nevertheless suffer losses if, for example, there are payment delays or defaults on the underlying loan receivables and/or the realisation proceeds from the collateral deposited are insufficient.

From the investors' perspective, this kind of structuring of securitisation transactions strengthens their purely asset-backed character. From the originators' perspective, a portfolio whose individual receivables have an average rating of BBB or lower can be converted to a large extent into a senior AAA tranche; the first loss tranche with a lower rating than the portfolio is often financed by the originator.

STS and ECB eligibility

With the STS seal, the Securitisation Regulation introduced a new quality standard (see Regulation). STS eligibility ensures the uniform and consistent regulation of securitisation throughout Europe, from the originator to the investor. As a quality feature, it has a particularly positive influence on the tradability and thus the liquidity of securitisation transactions and therefore tends to reduce the spread.

Another important feature of securitisations is their ECB eligibility. The ECB eligibility of ABS is particularly important for bank investors with regard to the diversification of refinancing. They can rely on ECB accepting securitisations as collateral for repo transactions within the framework of its monetary policy measures. ECB eligibility is also important for non-bank investors such as funds, asset managers or insurers, as it is expected to increase liquidity in the secondary market.

Further information

The following criteria are a requirement for the ECB eligibility of ABS (last amended in December 2018):

- The issue of the notes in euros

- Two ratings of at least A- from two officially recognised rating agencies

- True sale securitisation

- No ABS included in the securitisation

- Originator and SPV are domiciled within the EEC

- Debtors of the loan receivables must be either companies or consumers

- Only the senior tranche is accepted

- Loan-level data is provided through a securitisation repository (see European DataWarehouse)

The ECB is not expected to make STS a prerequisite for ECB eligibility. However, it is unclear whether or to what extent the ECB will take STS into account as a criterion in the future when calculating haircuts.

Many specially structured retained transactions have been arranged since 2008. Here, a bank securitises parts of its portfolio for the sole purpose of generating eligible collateral, i.e. to hold these as a liquidity reserve on the asset side of its balance sheet and to refinance if required through the ECB at favourable conditions.

A typical securitisation is for example an ABS transaction based on bank loans

- An ABS transaction begins when a bank, as the originator, selects a suitable portfolio of loans for securitisation. Loans can be, for example, loans to SMEs, housing loans, consumer loans or car financing.

- An arranger (or underwriter) plans, organises and structures the transaction together with the originator.

- The arranger determines the best possible tranching for the securitisation, taking into account the structure and expected performance of the receivables, coordinates the rating process and aligns the structure with the needs of the originator and investors.

- The originator sells the receivables to the SPV in the form of an undisclosed assignment (cession), ideally in the form of a legal, economic and balance sheet disposal.

- The SPV now issues various tranches of securities (notes). The tranches or notes are differentiated according to their ranking. The tranche with the highest ranking is usually referred to as the senior tranche, followed by the mezzanine tranches. The tranche with the lowest ranking and highest default risk is the junior tranche.

- The securities are generally rated by at least two rating agencies prior to issue. The junior tranche is usually an exception in this regard. The originating bank often retains this risk (first loss) itself.

- The notes are placed on the capital market via the SPV with the involvement of the arranger and acquired by investors.

- The SPV uses the proceeds from the issue of the notes to pay the purchase price for the loan portfolio.

- The originating bank receives the payment from the sale of the loan portfolio, which completes the issue of the ABS transaction.

Other parties to the transaction

A data trustee is involved to ensure that the personal data of the debtors is not passed on when the receivables are sold, thereby jeopardising banking secrecy and the bank-customer relationship. The data trustee receives the customer and credit data and can pass it on to third parties only if necessary (for example, if a debtor becomes insolvent).

A collateral trustee, usually a specialist service provider or an auditing firm, takes control of the collateral and ensures the proper processing of all payment flows in the interests of the investors.

The servicer carries out the day-to-day administration of the loans, i.e. loan monitoring, the collection of repayments and interest, the dunning process and, in the event of a default, the realisation of collateral. Due to its close links to customers and its administrative expertise, the servicing of receivables (loan administration) generally remains with the originating bank, even if it is no longer the legal and/or beneficial owner of the receivables after they have been sold. For the ultimate borrowers, for example consumers or SMEs, this means that the securitisation has no effect on the customer relationship with the lending bank. The bank-customer relationship does not usually change as a result of securitisation.