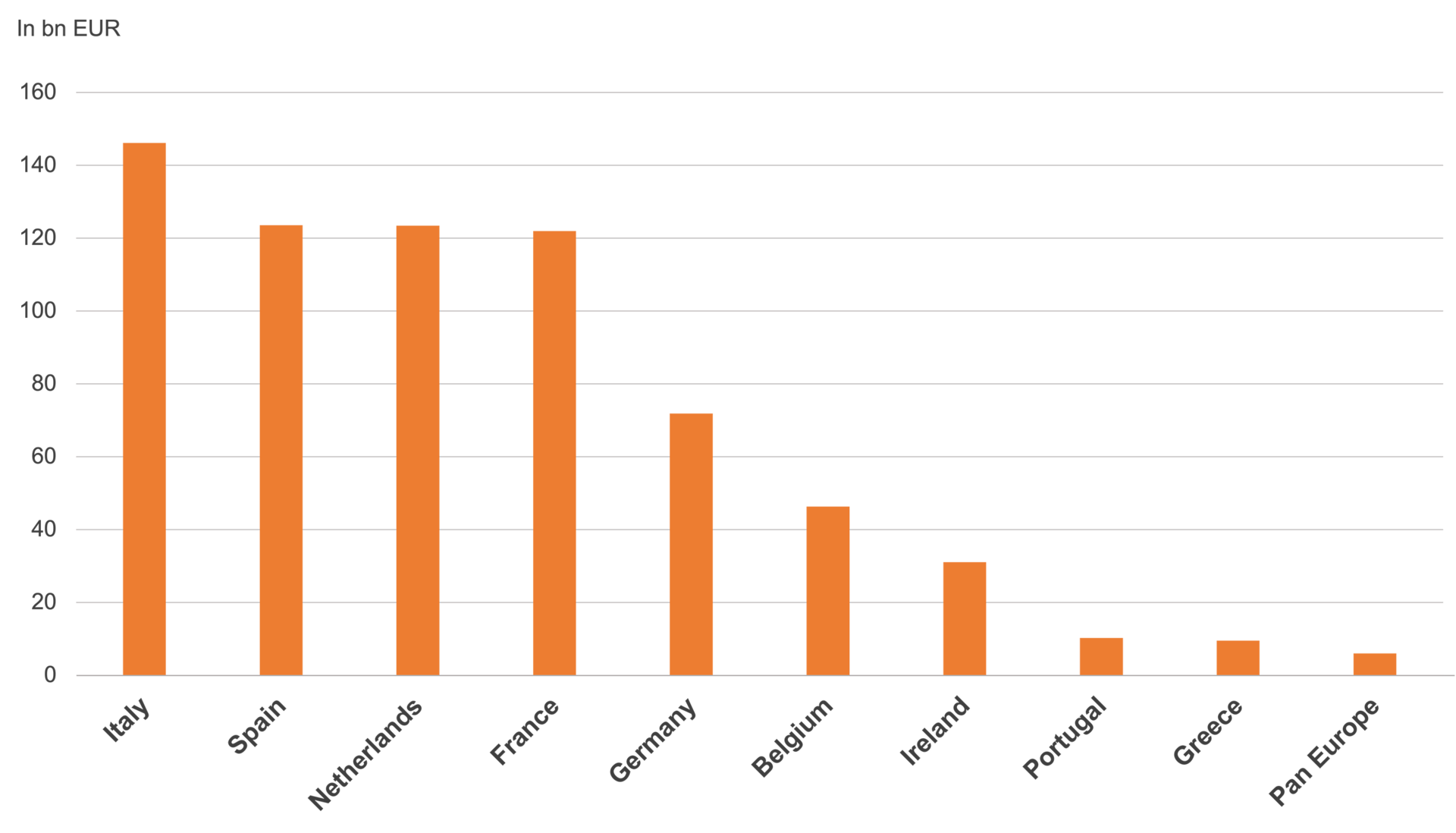

It is also interesting to look at the distribution of outstanding volumes by country. Compared to the size of the economy, securitisation is of only minor importance in Germany. In smaller economies such as Italy, Spain and the Netherlands, where RMBS has traditionally played a major role, outstanding securitisation volumes are greater than in Germany.

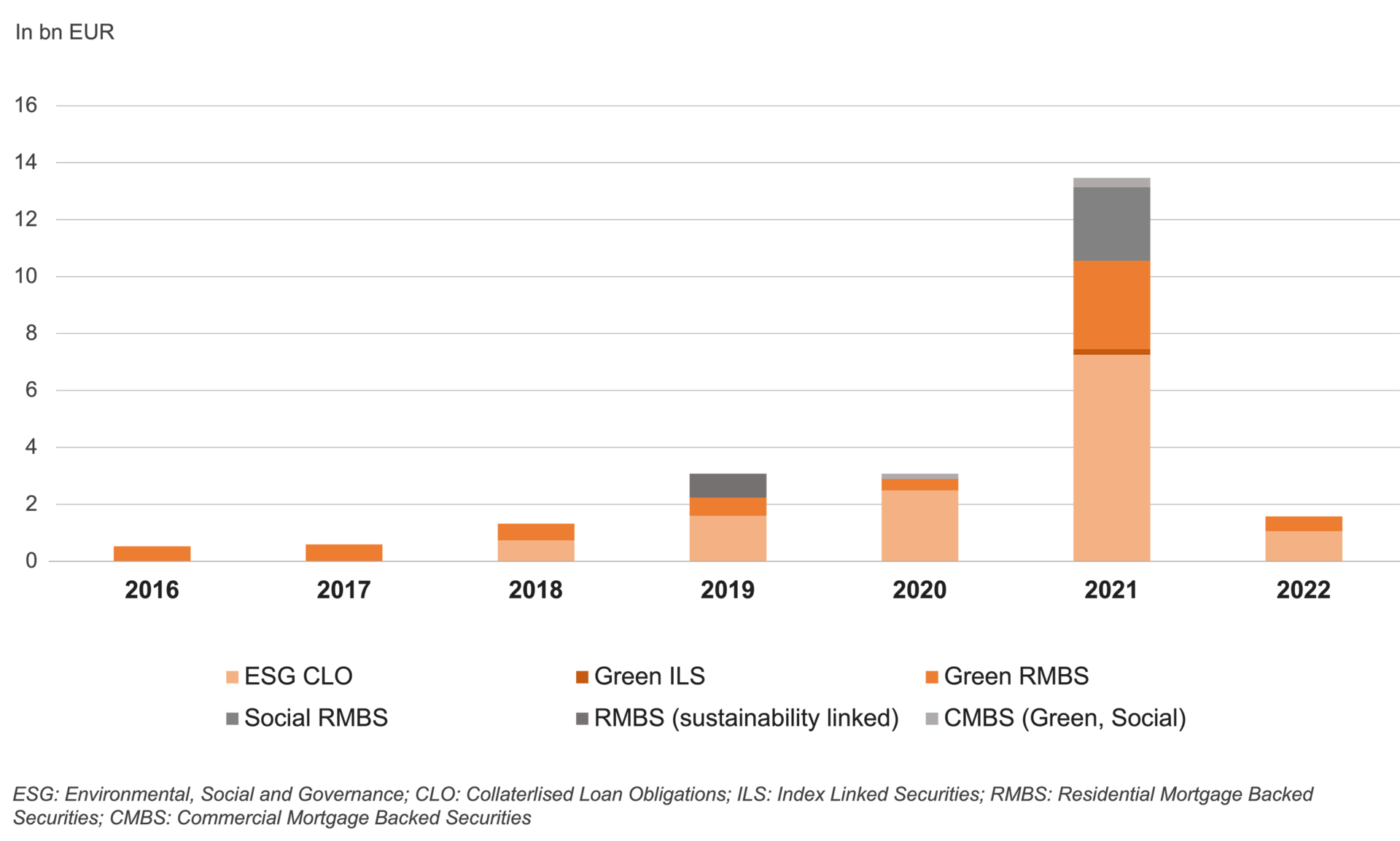

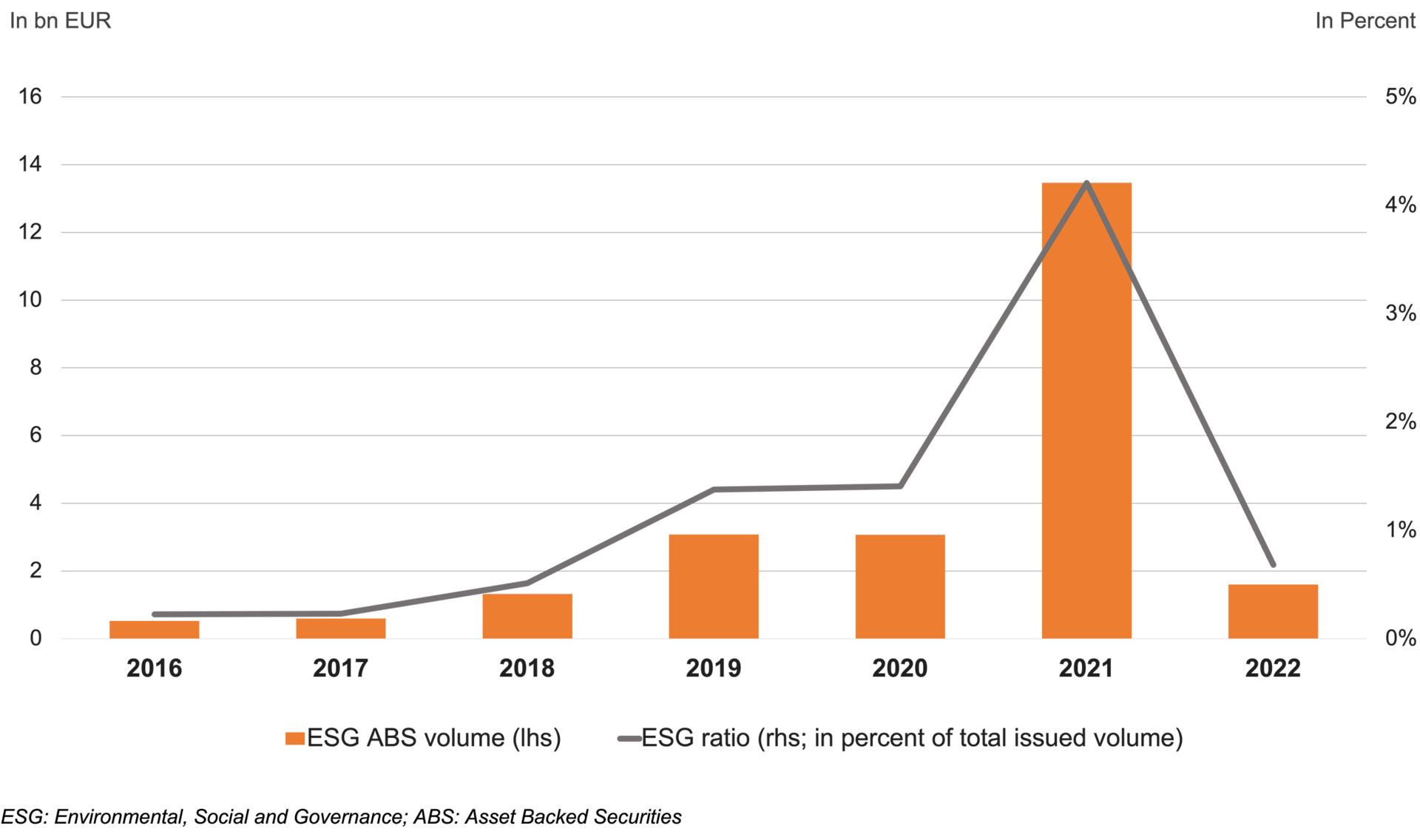

The market for green and other sustainability-oriented (ESG) securitisations in Europe entered a period of dynamic development in 2021. The main driver of growth was CLO transactions, where M&A-driven leveraged loans are securitised. The general market decline in CLO transactions is regarded as the main reason for the significant decline in ESG transactions in the securitisation market in 2022. Other reasons were uncertainty regarding the design of the EU Green Bond Standard (use-of-proceeds approach versus ESG-compliant portfolio), increased risk awareness with respect to greenwashing and limited growth potential in sustainability-oriented real estate loans and electric vehicles as household incomes were depleted in the wake of inflation.

However, with a total volume of over EUR 400 bn in ESG issues, it was already clear in 2021 that the securitisation market still had great potential in the ESG area. The reasons for this are discussed in the Sustainable Finance section.

Under the Eurosystem, a unified Single List collateral management framework has been in place since 2007. The ECB provides detailed information on the rules governing the implementation of monetary policy and the collateral framework. Since then, the ECB has amended or replaced the previous guideline on the implementation of the Eurosystem's monetary policy framework several times. The most recent amendments are ECB/2018/3, ECB/2018/4 and ECB/2018/5. For more information go to: Current ECB Guideline on Collateral Eligibility (ECB/2018/5).

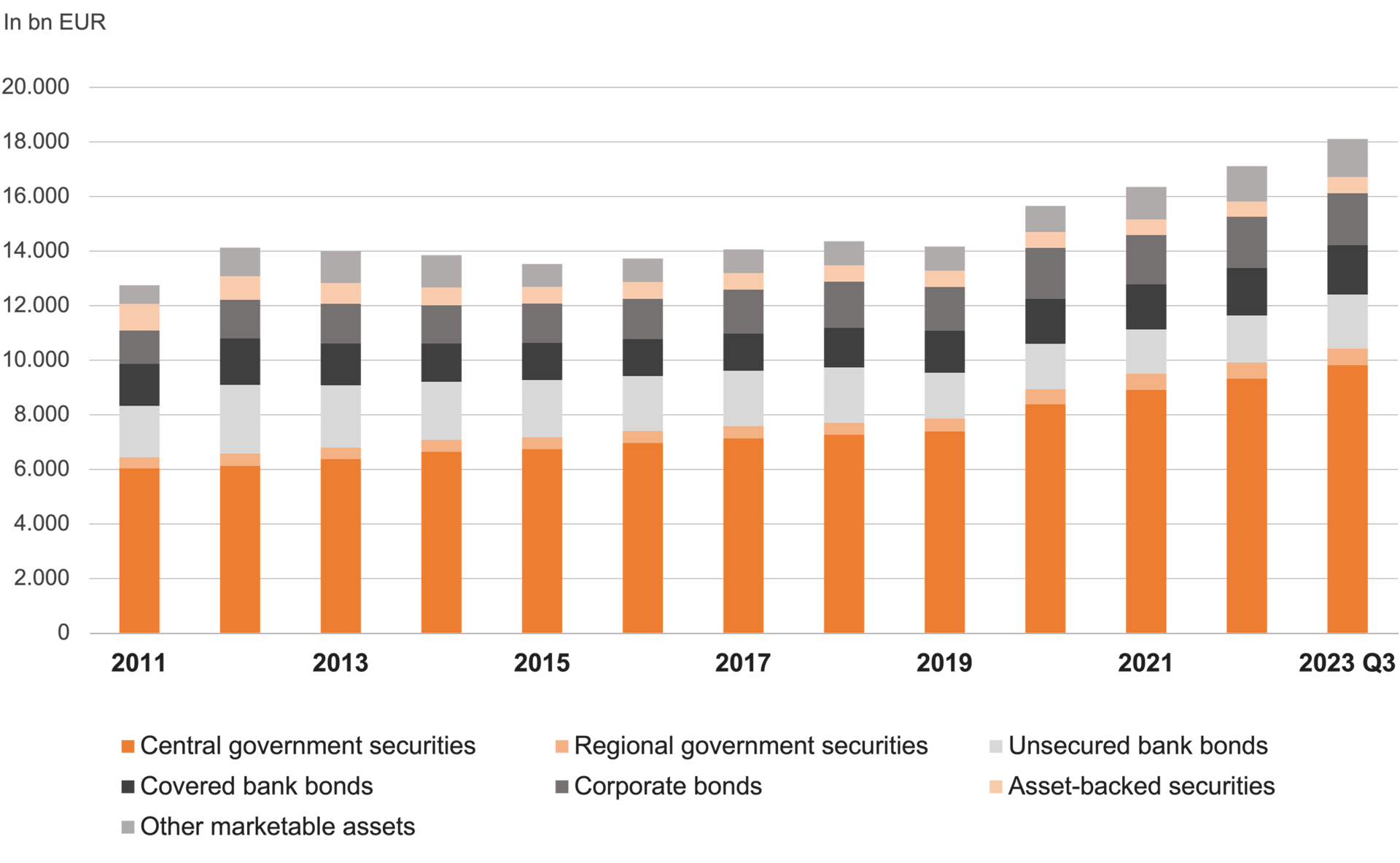

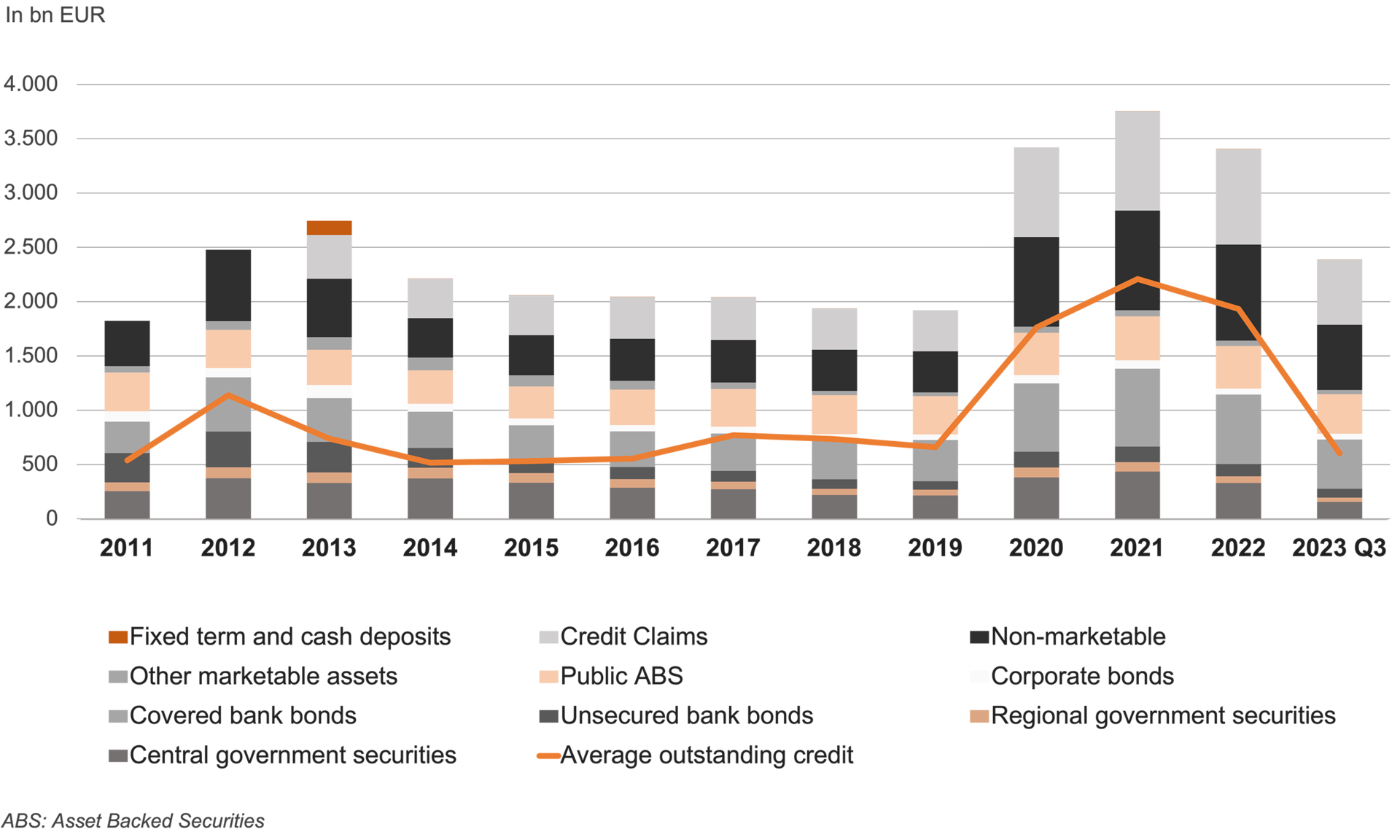

The qualitative requirements on marketable collateral and the haircuts applied in this context are of particular importance here. As the following market data show, however, public ABS make up only a small part of the collateral spectrum eligible for lending at the ECB. However, they are disproportionately used by banks to diversify their refinancing, and the ECB's influence on market development can be classified as high.

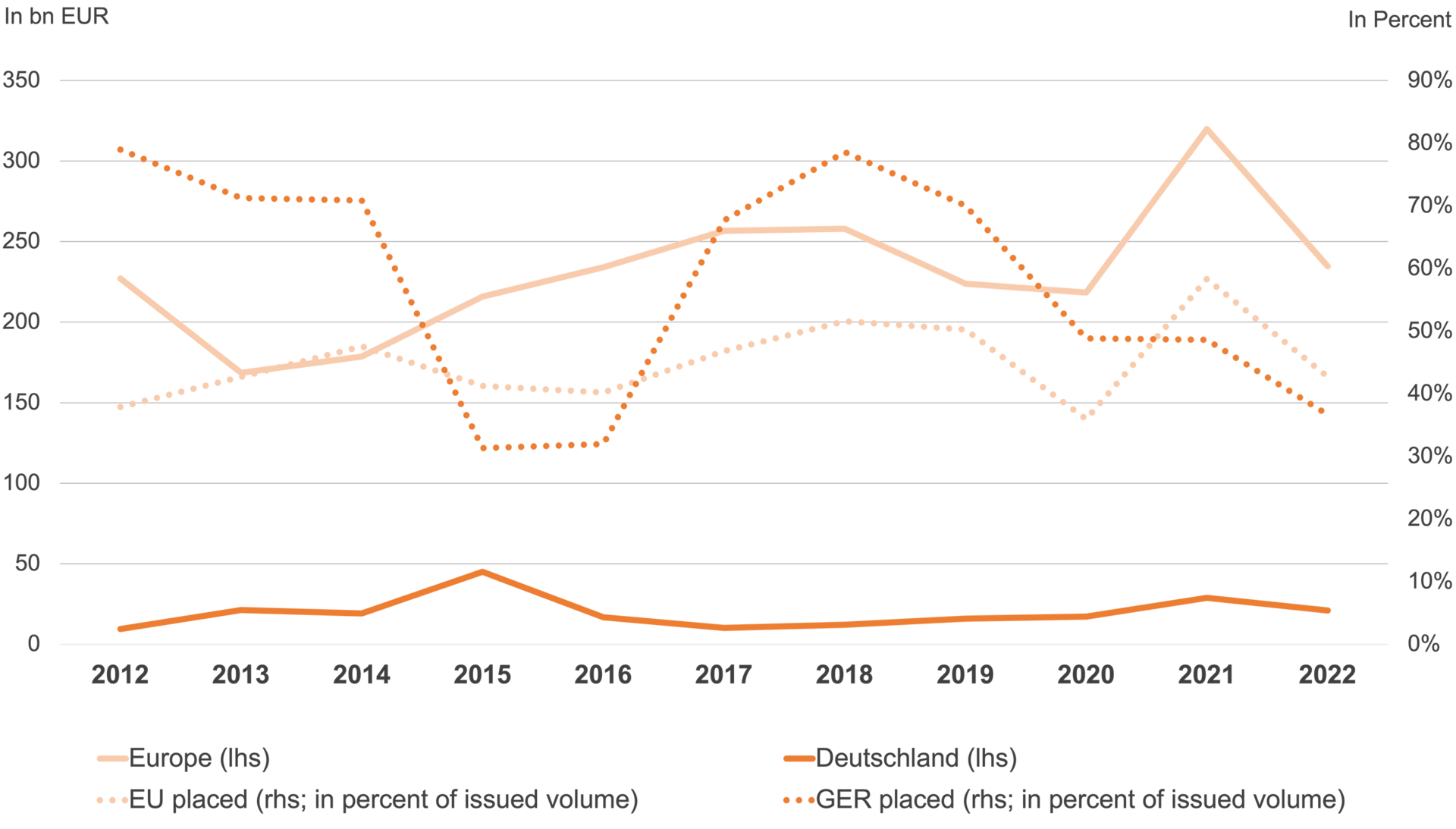

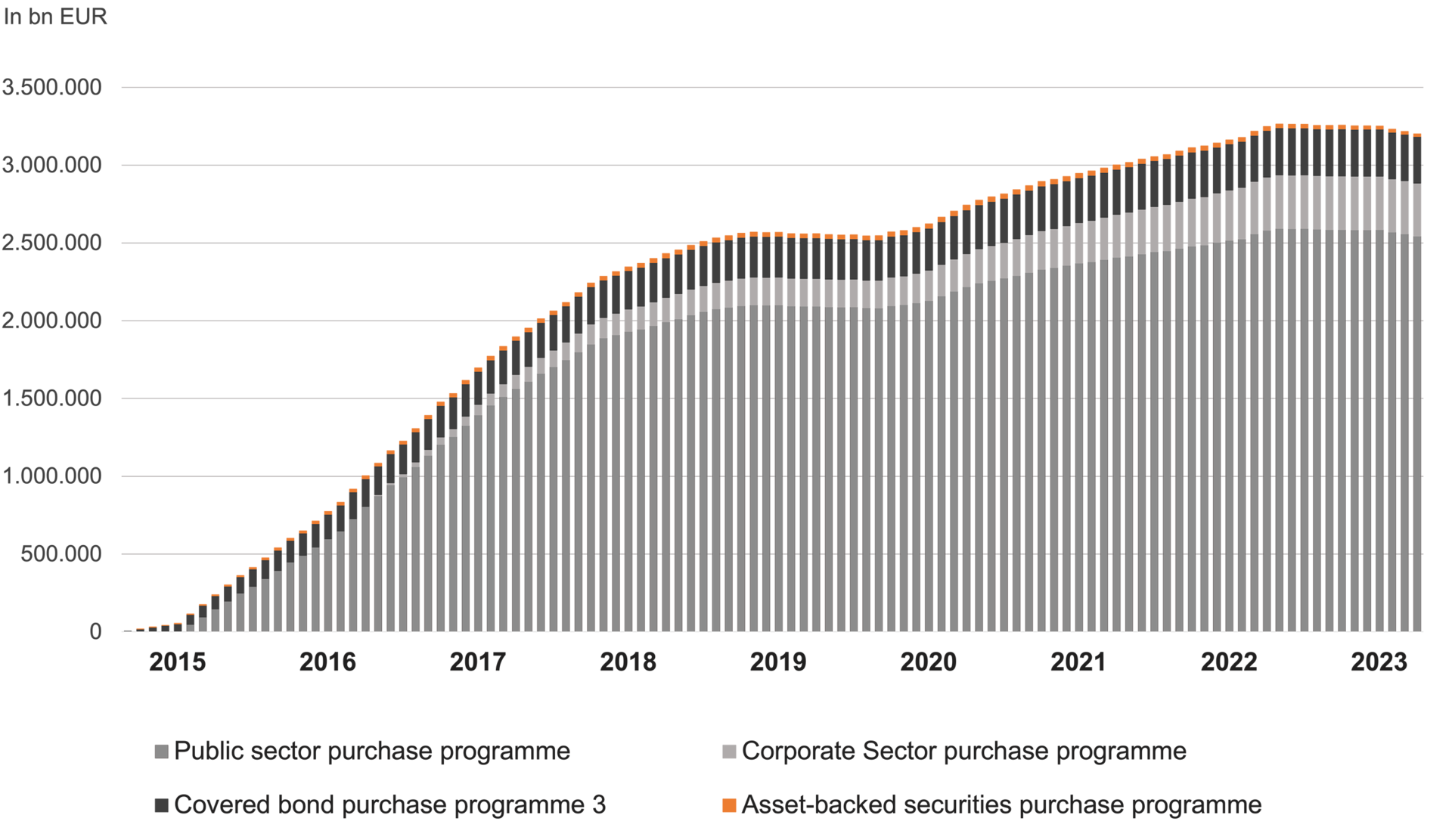

Since 2015, the ECB has purchased bank assets directly at various times under its asset purchase programme (APP). It also purchases public ABS under the asset-backed securities purchase programme (ABSPP). The ABSPP has a direct influence on market developments in Europe as the banks can avail themselves of this low-cost refinancing option and they do not issue securitisations on the market.

The chart shows that public-sector ABS are of only marginal importance for bank refinancing. It remains to be seen how the expiry of the purchase and tender programmes as a result of the change in interest rate and monetary policy from mid-2022 will affect the further market development of ABS. The APP will therefore lead to greater demand in relative terms for covered bands as well as increased asset encumbrance and procyclicality in the financial system. The impact of the expiry of the APP and subsequent reductions in the ECB's balance sheet following the change in interest rate and monetary policy since mid-2022 remains to be seen.

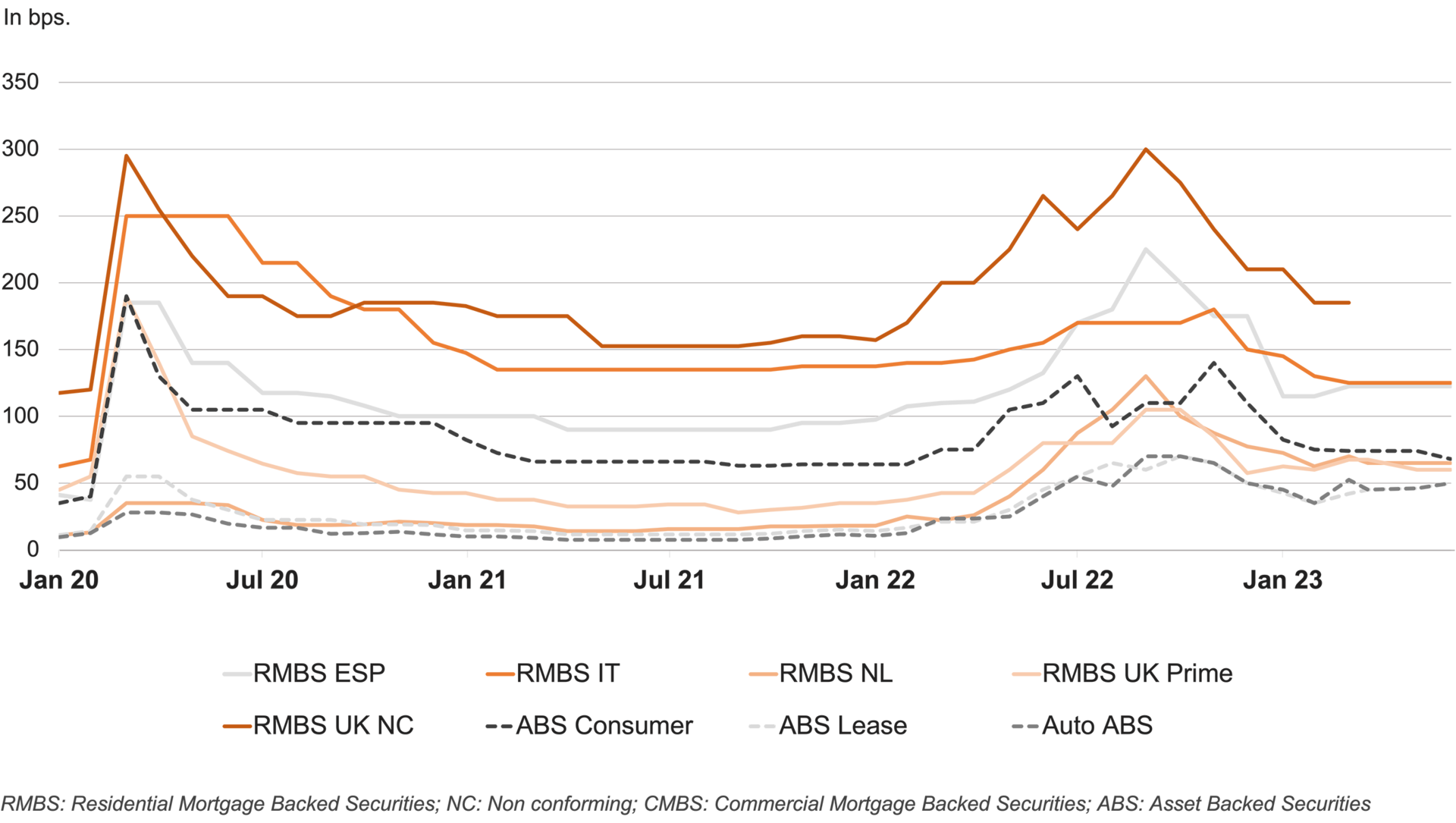

Public securitisations in Europe are regularly issued as floating rate bonds, and the yield is measured as a spread in basis points above a reference interest rate (usually 1 month Euribor). The charts below show how spreads depend, among other things, on the macroeconomic environment, and how the biggest changes are reflected in the period of the euro debt crisis in 2013 and the start of the corona pandemic. In terms of short-term developments, we can see that the renewed widening of spreads triggered by the Ukraine war was reversed at the beginning of 2023. Overall, the auto ABS asset class, which is particularly important for the German market, has proven to be the most stable.

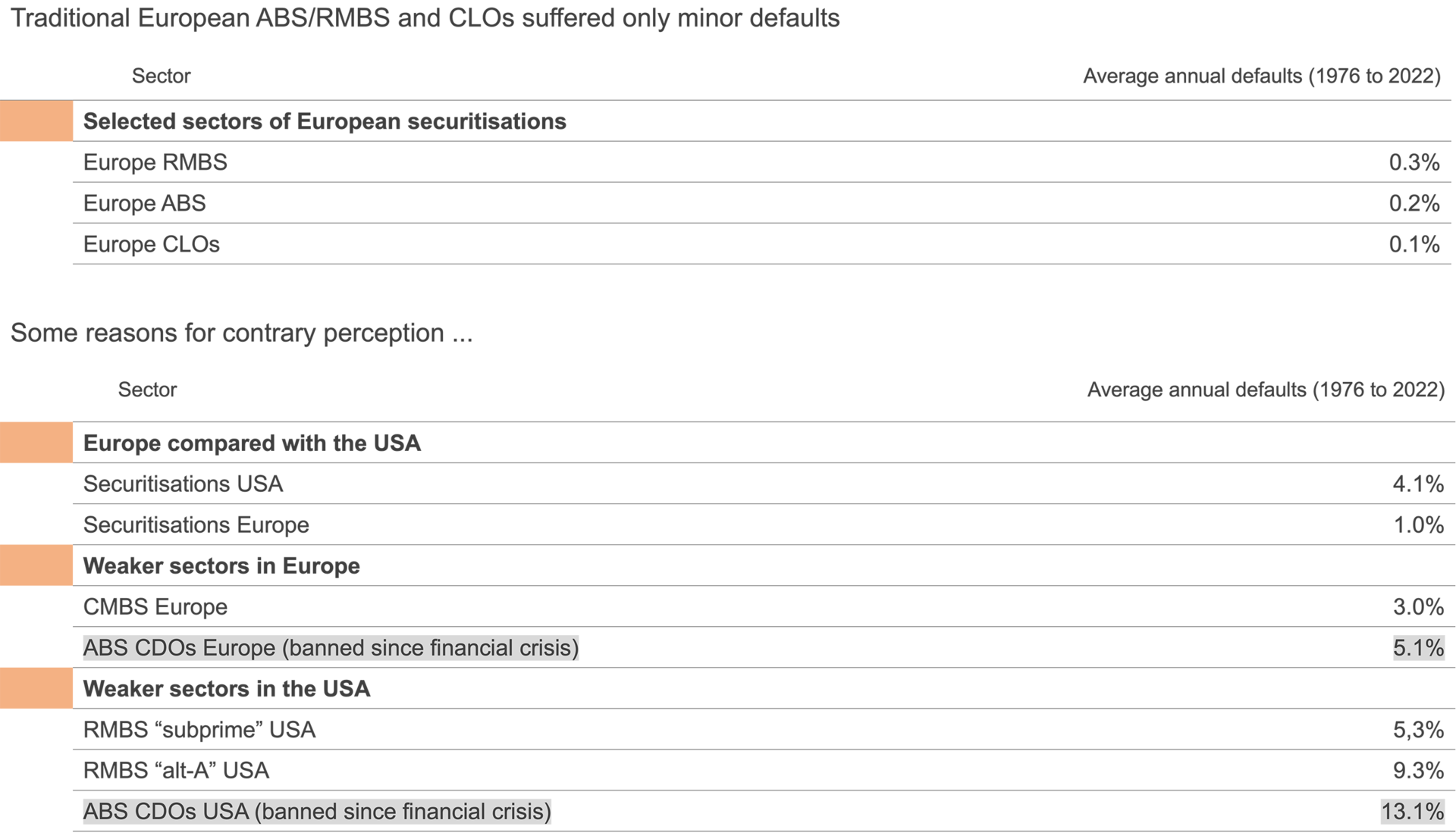

In their investor reports, originators provide extensive data on the performance of public securitisations. These relate to time series of the securitised portfolio as well as the entire portfolio of the securitised asset class held by the originator through to the contract data of the securitised loans at individual receivable level. This can be used to compare the performance of securitised and non-securitised assets under the same conditions of issue. Research analysts at banks and investors as well as rating agencies and other service providers carry out a wide variety of analyses. Securitisation is therefore a highly transparent asset class in Europe. The reasons for the increased default rates during the financial crisis do not originate directly from European securitisation products:

- American subprime loans as an asset class demonstrated a number of risks.

- In particular, the low creditworthiness of borrowers, inadequate incentive structures and lack of due diligence by banks, rating agencies and investors were decisive factors

- In many cases, poor due diligence of investors

- As a result, European securitisations contained bad paper from the USA

- Re-securitisations and synthetic arbitrage transactions further impaired their quality

- In addition, substantial maturity transformation through structured investment vehicles (SIV)

- The sudden disappearance of refinancing options via short-term commercial paper resulted in considerable losses for banks and other investors

- Addressing both problems by prohibiting re-securitisations and introducing the LCR, which takes into account the potential use of liquidity lines

- The default rates of European securitisations are (and have been) consistently low, even if public perceptions sometimes differ