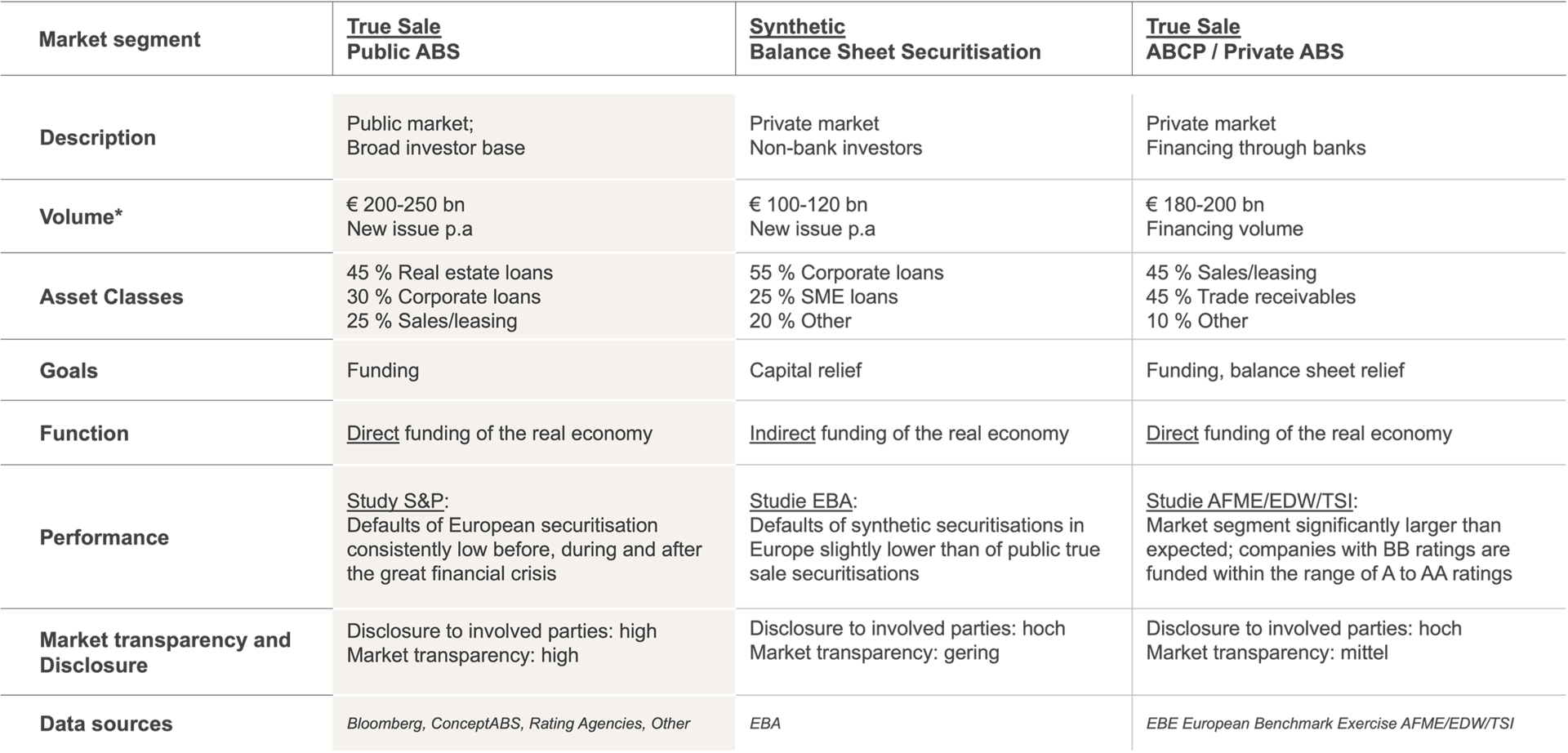

In practice, the originator's objectives are initially paramount when selecting the transaction type. A strong financing effect is achieved through a true sale. When choosing between public ABS and ABCP securitisations, transaction size and fixed costs play a decisive role. If the focus is on risk transfer and regulatory capital relief for banks, the objective can usually be achieved more efficiently via balance sheet securitisation (synthetic).

Good performance and public perceptions

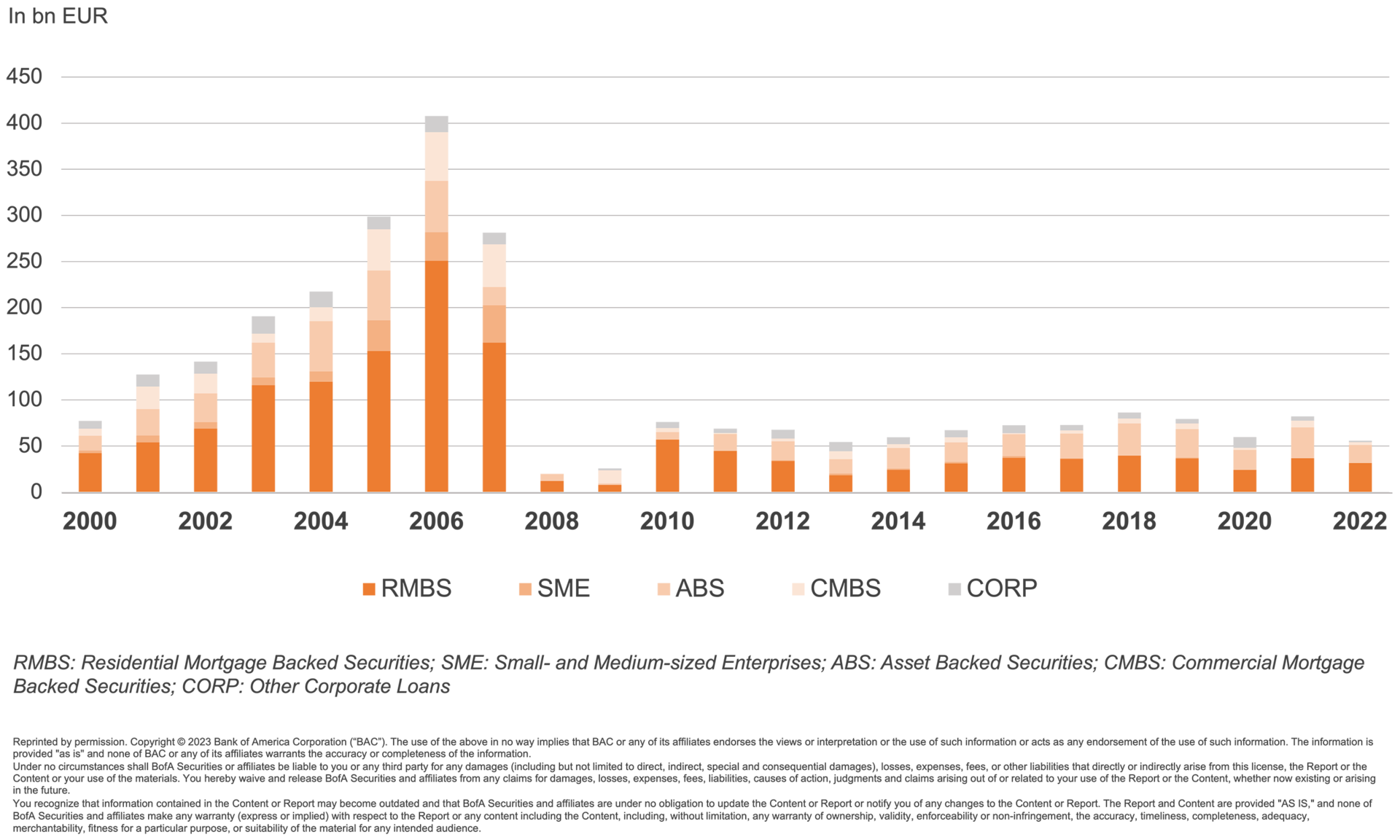

Since the global financial crisis in 2008, securitisation has often been viewed critically in the public sphere. However, this broad perception is at variance with the positive and proven performance of European securitisations –- before, during and after the financial crisis. In contrast to the USA, Australia and China, the securitisation market in Europe has hardly grown since the global financial crisis.

Reasons for poor market growth:

- The new regulatory framework for securitisations, which was initiated in 2012, was not implemented until 2019 and has led to a long period of uncertainty. In addition to numerous detailed provisions, the capital weightings for securitisations were significantly increased, and this was only partially compensated for by the introduction of STS securitisations.

- The ECB's loose monetary and interest rate policy meant that securitisation was often not necessary as a form of refinancing.

- High default rates in the USA were projected onto Europe by policymakers and the media (see “Public ABS” – “Performance”).

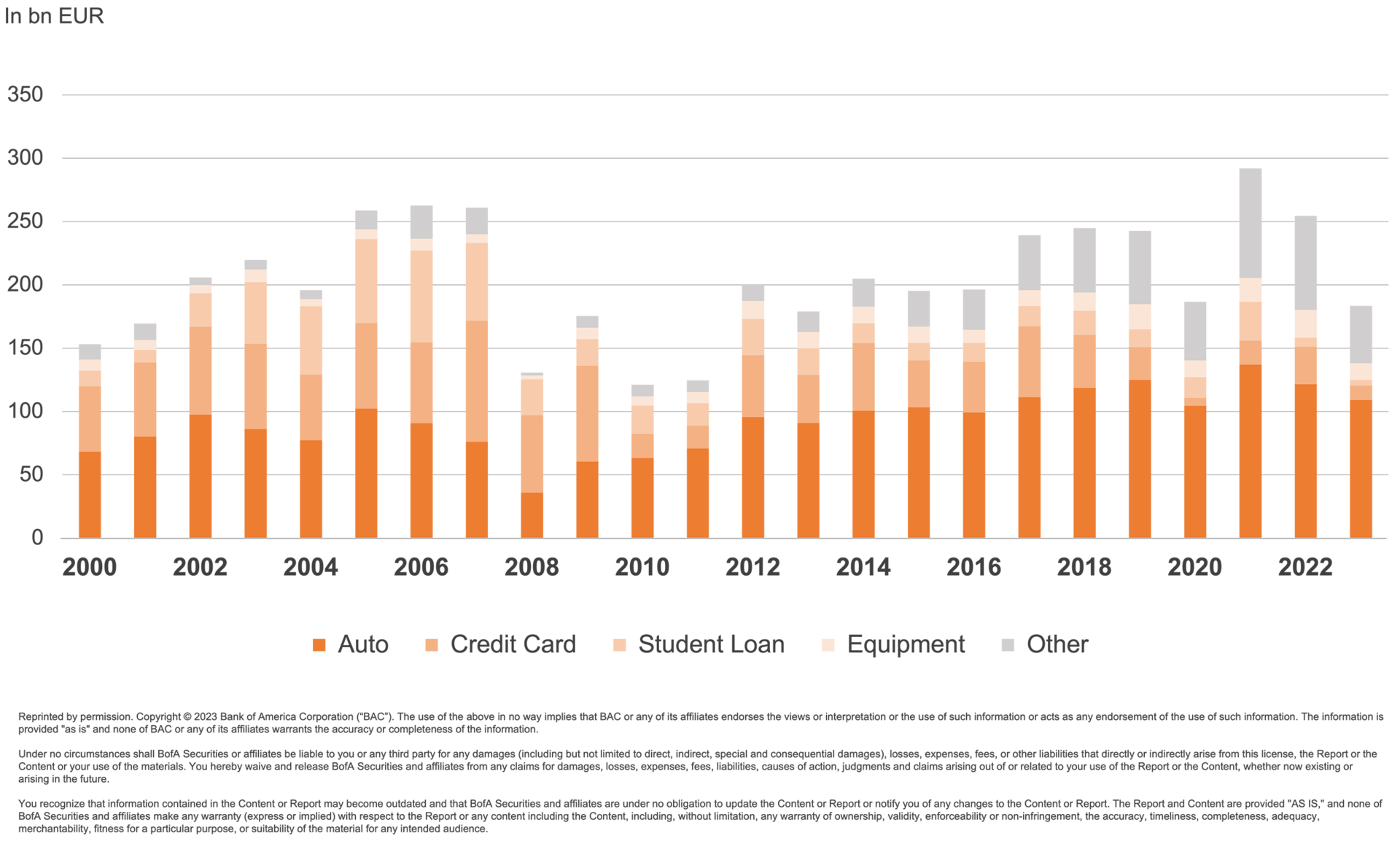

In recent years, the European securitisation market has therefore shown only moderate growth – especially in comparison to the US market.

While the European market has largely stagnated since 2008, the American market is already back at pre-crisis levels. The comparison with the US clearly illustrates the market potential that exists in Europe. If there is a change in public perceptions, securitisations can also make a contribution to the capital markets union in Europe.