For the time being, the regulations on Sustainable Finance do not result in transparency requirements on ESG information ‘from a single source’. However, the EU legislators have declared their intention to create a uniform ESG disclosure framework in the future.

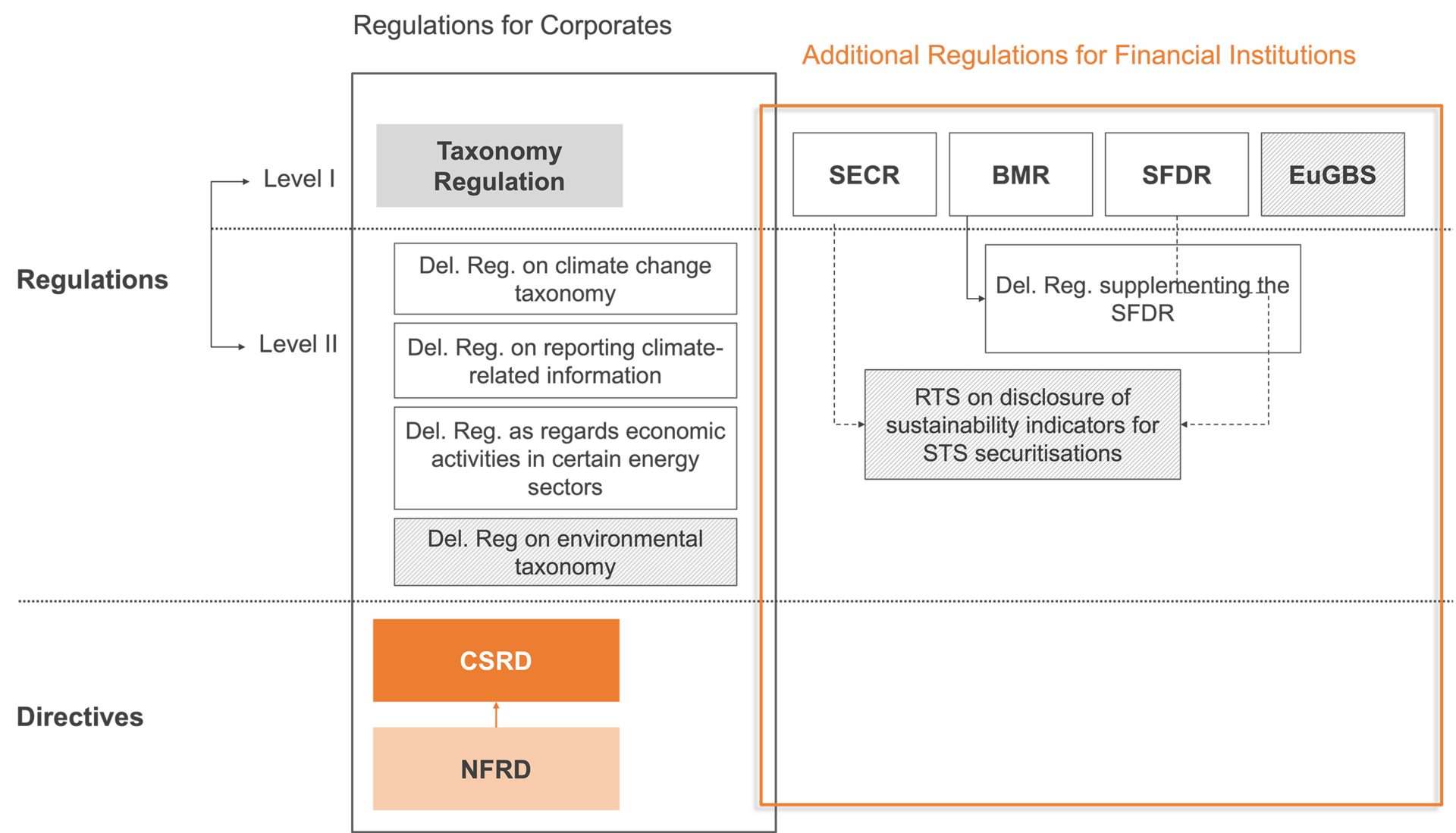

Sustainable Finance comprises numerous parallel legislative procedures at Level 1 and Level 2.

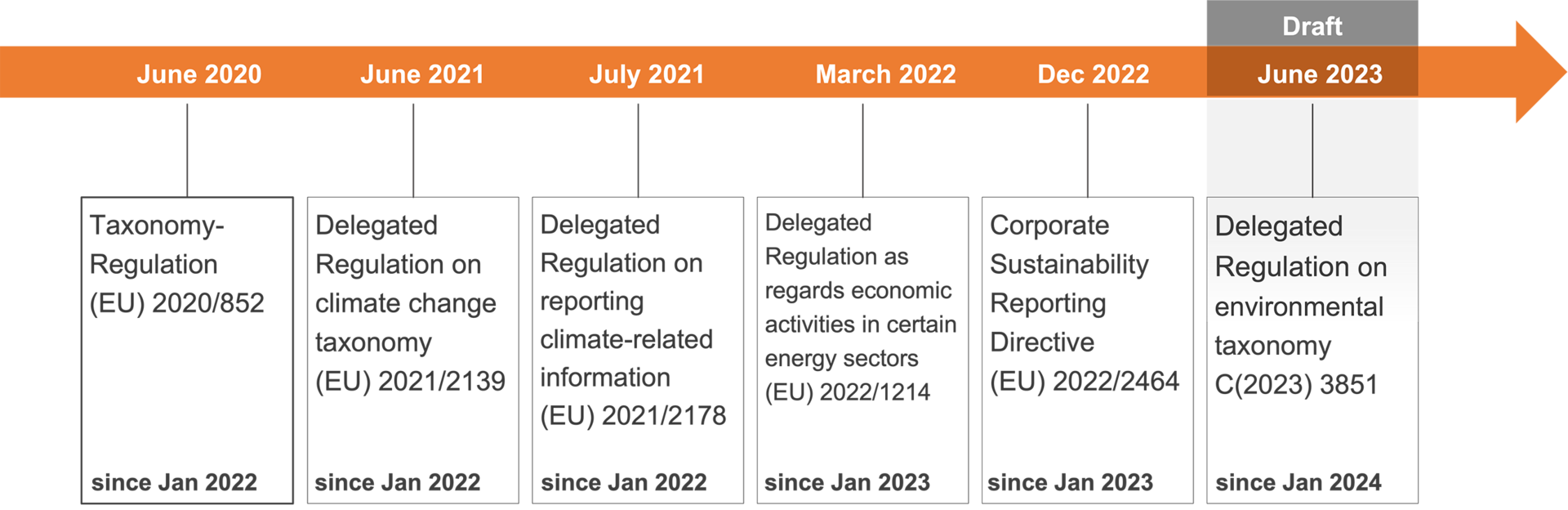

The legislation for the Taxonomy Regulation (Level 1) is the most advanced, with the associated legislation at Level 2 for the ‘Environmental’ area almost completed. Currently (as of October 2023), one exception is the Delegated Regulation on environmental taxonomy, which is available as a draft only (shaded area in Figure 2). Legislation at Level 2 on the 'Social' and 'Governance' areas is largely undecided.

The Taxonomy Regulation specifies what is to be reported on; associated delegated regulations determine what is to be reported and in what form. The Corporate Sustainability Reporting Directive (CSRD) for all companies in the real and financial economy, which is based on the previous Non-Financial Reporting Directive (NFRD), regulates who has to report.

In addition, further regulations apply to the financial sector at Level 1. The Securitisation Regulation (SECR) includes regulations on Sustainable Finance. In addition, the climate-related Benchmark Regulation (BMR) and the Sustainable Finance Disclosure Regulation (SFDR) already apply at Level 1; EU legislators adopted the European Green Bond Regulation (EuGB) in October 2023. The climate-related BMR defines how transparency and cross-product comparability are to be ensured for selected targets in the ‘Environmental’ area. The SFDR focuses on sustainability in investment products from the relevant providers and buyers. The EuGB also focuses on the issuance of sustainability-oriented securities, including securitisations.

In terms of legislation for the financial sector, comparatively little has happened so far at Level 2, and only in the ‘environmental’ area. The provisions in the delegated regulations on the SFDR, the Regulatory Technical Standards (RTS) on the SECR and the EuGBS (see in Figure above) appear to be poorly coordinated. Therefore, it is hardly possible to speak of a uniform ESG disclosure framework at present. Nevertheless, all regulations have a reference to the central Taxonomy Regulation.

The Taxonomy Regulation is the guideline for measures to set requirements for the real and financial economy. However, it looks through companies, investment products or securities and classifies individual ‘economic activities’. In this way, it determines whether an economic activity is sustainable or not. It thus provides a basis for more effective steering of financial and investment flows towards a sustainable economy.

For the time being, the scope of the Taxonomy Regulation for the real economy is limited to economic activities of selected sectors. These currently include the sectors with the highest environmental relevance or the most greenhouse gas (GHG) emissions in the EU. On the basis of the legal requirement, the economic activities of these sectors are (taxonomy eligible).

With the help of predefined Technical Screen Criteria (TSC), companies must, for the time being, determine whether and to what extent an economic activity contributes to the following sustainability goals in the ‘Environmental’ area:

- Climate change mitigation

- Climate change adapation

- Sustainable use and protection of water resources

- Transition to a circular economy

- Prevention and reduction of environmental pollution

- Protection and restoration of biodiversity and ecosystems

The economic activity of a company is 'taxonomy aligned' if it

- makes a significant contribution to at least one of the six sustainability goals in the 'Environmental' area,

- does not at the same time cause any significant harm (Do No Significant Harm, DNSH) to any of the other sustainability goals in the ‘Environmental’ area and

- meets minimum social standards at the same time.

In 2022, companies with usually more than 500 full-time positions initially only had to report on taxonomy-relevant economic activities retrospectively for the past business year. From the beginning of 2023, the companies concerned must indicate in their non-financial statement to what extent taxonomy-relevant economic activities are also taxonomy-compliant.

For this purpose, the shares of

- revenues, (Turnover),

- capital expenditure (CapEx) and

- operational expenditure (OpEx)

that are associated with sustainable economic activity have to be identified.

Currently (as of October 2023), information on taxonomy-compliant economic activities is limited to the climate-related objectives 'Mitigation' and 'Adaptation'. The Delegated Regulation on reporting climate-related information of July 2021, supplemented by the Delegated Regulation as regards economic activities in certain energy sectors (i.e. nuclear energy and natural gas) of March 2022, ensures a uniform methodology for determining climate-related ESG information. Both regulations have been legally effective since January 2022 and January 2023, respectively.

With the draft Delegated Regulation on Environmental Taxonomy of June 2023, which is expected to come into force in 2024, TSCs are available for further taxonomy-relevant economic activities. On this basis, the companies concerned must report and disclose taxonomy-compliant economic activities for the other four objectives in the ‘Environmental’ area (water, circular economy, pollution and biodiversity).

The Taxonomy Regulation is a living document. So far, it covers only a part of all economic activities. The legislator revises the taxonomy at least every three years; existing regulations are grandfathered for five years. This ensures that new sectors and activities can be included in the legislation over time. The Taxonomy Regulation only specifies what is to be reported on and what matters are to be reported - it does not specify the target group of sustainability reporting.

The Corporate Sustainability Reporting Directive (CSRD), which has been in force since January 2023, is intended to create the conditions for reliable and comparable data on ESG information from companies. The European Commission presented a first draft for this in April 2021. The CSRD refers directly to the Taxonomy Regulation and specifies target groups for sustainability reporting. It builds on the previous Non-Financial Reporting Directive (NFRD) of 2014 and expands its scope of application.

With the CSRD, the European legislator wants to put non-financial or sustainability reporting on the same level as financial reporting. The European Financial Reporting Advisory Group (EFRAG) has been commissioned to develop European Sustainability Reporting Standards (ESRS). The future European sustainability reporting standards should be compatible with the standards of the International Sustainability Standards Board (ISSB), which are being developed in parallel.