Securitisations are fundamentally governed by the Securitisation Regulation (EU) 2017/2402, which came into force on 1 January 2019. For the first time, it regulates securitisation in a uniform and comprehensive manner across Europe for all segments of the financial market. As this regulation created the quality segment for simple, transparent and standardised (STS) securitisations, it is often referred to as the ‘STS Regulation’, although it contains many other areas of regulation.

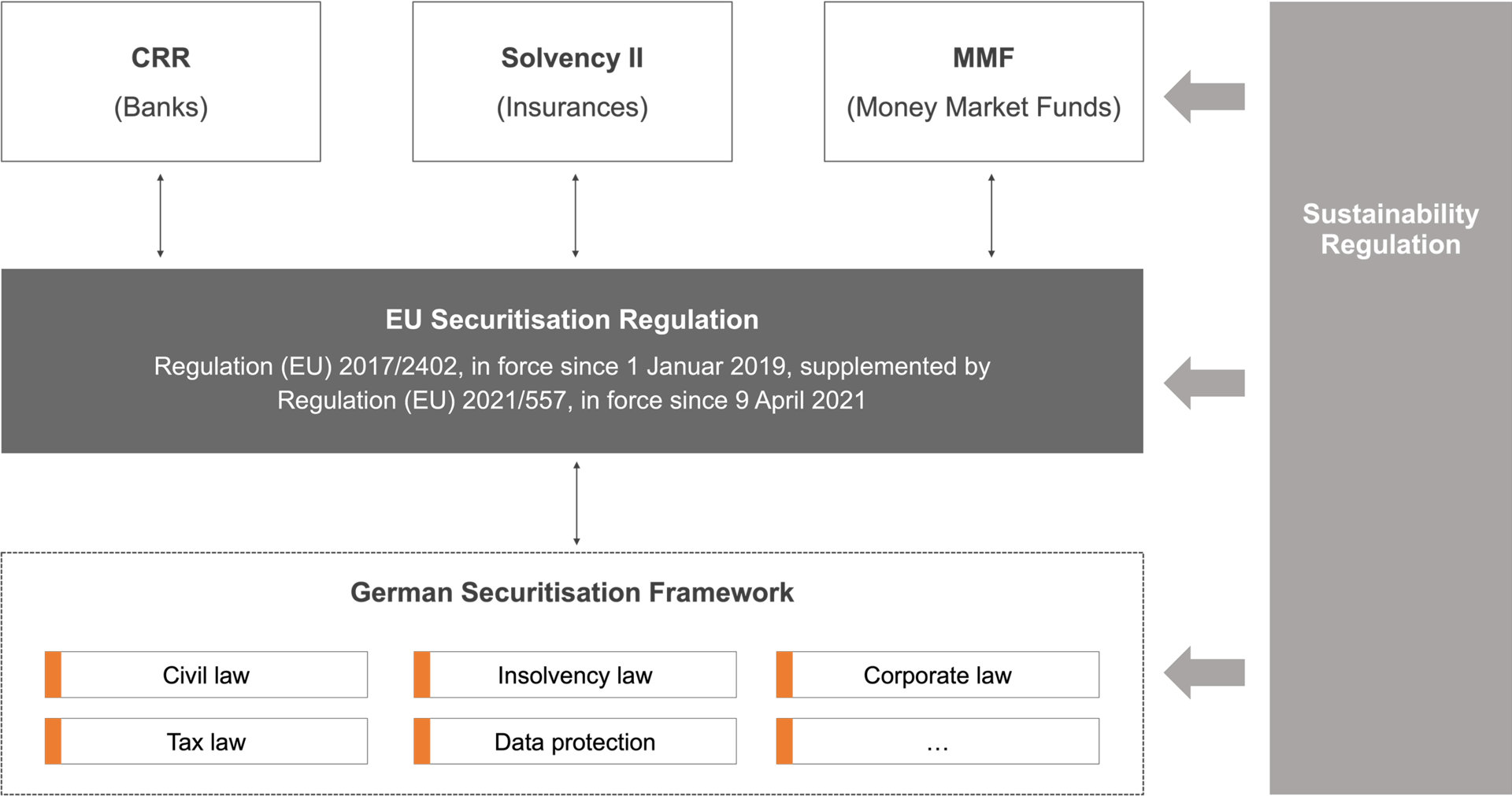

This means that unlike in the past, securitisations are no longer regulated separately for different financial market participants. Instead, the relevant provisions refer to the Securitisation Regulation and now only regulate how credit institutions, insurance companies and other investors must map a securitisation from a regulatory perspective. For a complete consideration of the legal provisions, the relevant national legislation must also be taken into account. It is particularly relevant for the creation of a true sale for securitisations. The regulations are also influenced by the provisions of the EU’s Sustainability Regulation.

The new STS regulation: background and motivation

With the revision of the Securitisation Regulation, the European Commission, the European Parliament and the Council of the European Union (‘Council of Ministers’) have taken account of the fact that securitisations are an important component of well-functioning financial markets. A soundly structured securitisation is an important tool for diversifying funding sources and promotes a broader allocation of risk in the European financial system. Securitisations thus contribute to improving the efficiency of the financial system and to making the conditions of the real economy more stable in a bank-dominated financing environment.

Therefore - as stated in the preface to the regulation - the development of a simple, transparent and standardised securitisation market is a core building block of the Capital Markets Union and contributes to the European Commission's priority goal of supporting job creation and a return to sustainable growth in Europe.

The new regulation governs the capital market instrument of securitisation uniformly and consistently from the originator of the securitised assets to the investors.