True sale vs. Synthetic securitisation

Traditionally, in a true sale securitisation, receivables are sold and transferred to an SPV. It is irrelevant whether the securities issued by the SPV are retained by the originator (retained transaction), submitted to the ECB (European Central Bank) as collateral or placed on the capital market. In a synthetic transaction or balance sheet securitisation of loans, however, the securitised receivables remain the property of the originating bank. Only the credit risk is transferred to the capital market. The aim of the bank is to reduce the burden on equity, i.e. to reduce the regulatory capital required to adequately cover the default risk of the loan portfolio. To this end, the bank endeavours to achieve a significant risk transfer (SRT, alternatively apply the full deduction method) in accordance with the capital requirement regulation (CRR) within the framework of a detailed supervisory audit. If the SRT is recognised by the supervisory authorities, the bank only has to back the default risk of a tranche with its own funds instead of each individual loan receivable. In this case, the desired capital relief is achieved through synthetic securitisation. The loans, however, remain on the balance sheet of the originating bank.

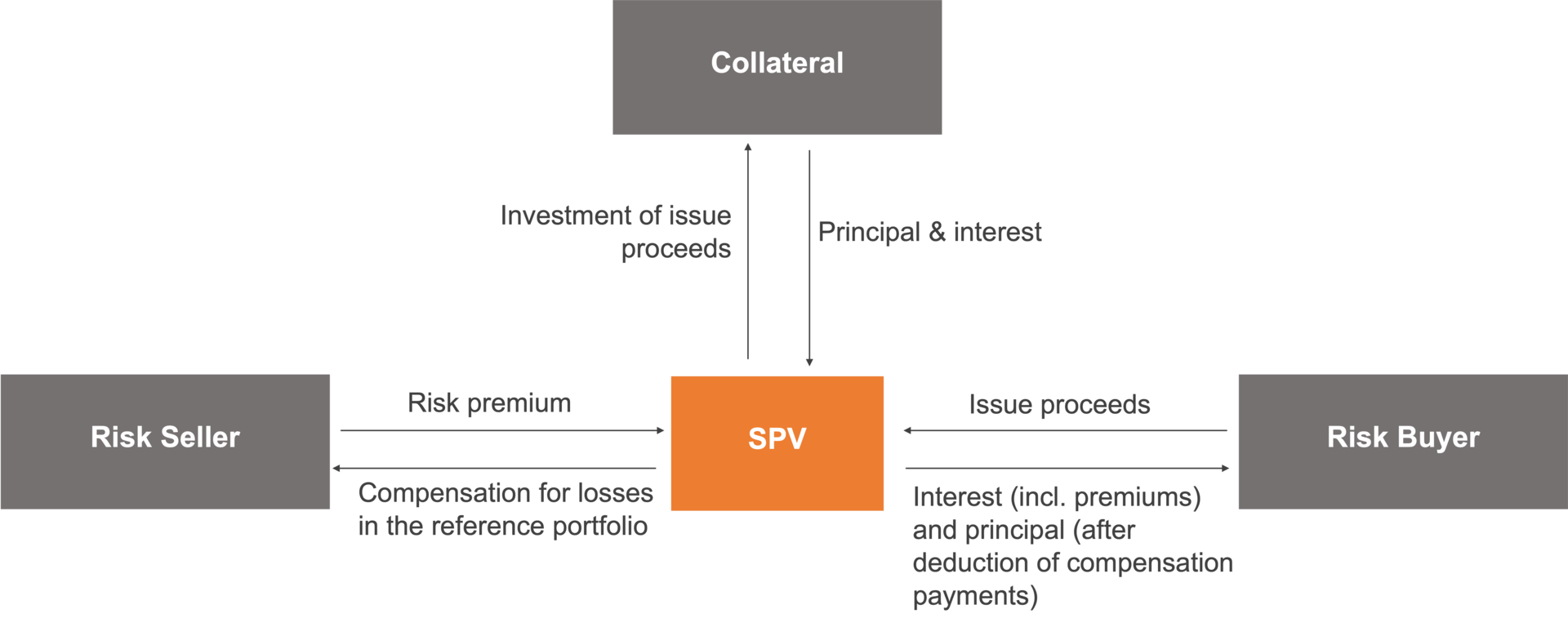

In synthetic securitisations, portfolio protection is provided via guarantees or the use of credit derivatives. A distinction is made between hedging without collateral (uncovered securitisation) using credit default swaps (CDS) and hedging with collateral (covered securitisation) in the form of credit-linked notes (CLN).

Hedging default risks with CDSs is essentially an insurance solution. In this case, the bank pays an investor a premium to cover potential losses from the securitised loans. Solutions for reference portfolios using CLNs are more complex, but also offer originators and investors more advantages, such as lower counterparty default risks and risk weightings.

In practice, therefore, covered synthetic securitisations are more commonly used nowadays. When CLNs are used, the bank places the risk of a loan portfolio on the capital market via the mezzanine tranches, either directly or via an intermediary SPV. The senior tranche with its lower risk is usually not worth placing and therefore retained. The proceeds from the securities serve the bank as cash collateral for the default risk in the reference portfolio. This achieves the desired reduction in regulatory requirements for the risk-adequate capitalisation of loans.

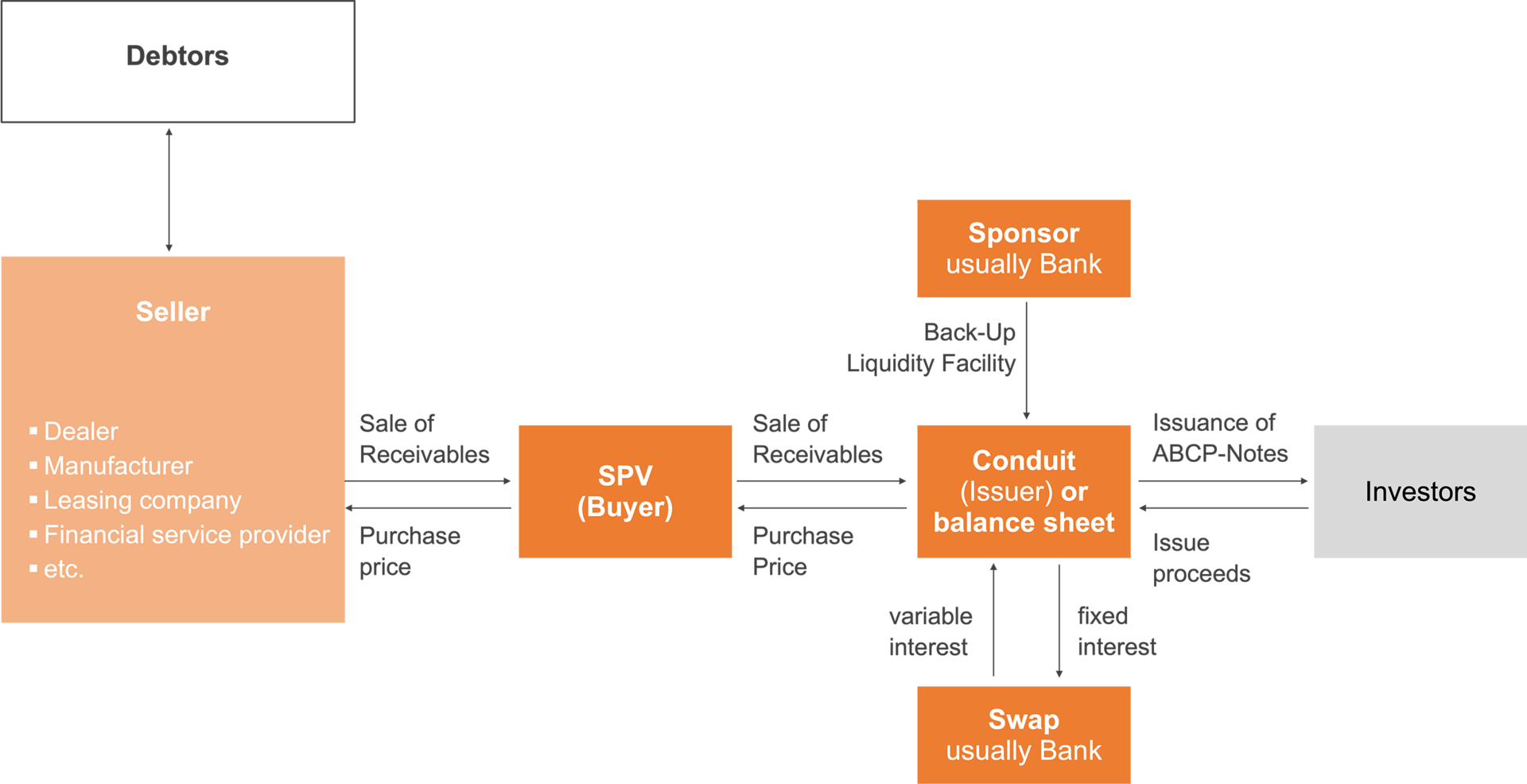

These assets are pooled and placed on the money market in the form of short-term securities. In the case of ABCP financing, the receivables are assigned as a true sale and undisclosed assignment, as with traditional securitisations. The receivables are purchased by an SPV at nominal value and in some cases at a discount. Outstanding receivables are often sold on a revolving basis as part of ABCP programmes. A large number of receivables sellers (multi-seller) as well as co-funding by several banks, via a special purpose vehicle (conduit) and/or via bank balance sheets (on-balance sheet transaction) can also be bundled and sold to investors. In contrast to the situation prior to the global financial crisis, ABCP sponsor banks are fully liable to investors for the repayment of the ABCP, making the instrument comparable to covered bonds from an investor's perspective.

Public vs. private transactions

In comparison to publicly placed securitisations, private transactions take greater account of the individual requirements of a small number banks – or a single bank – as major investors. As a result, the costs of structuring and financing can be significantly reduced, for example by dispensing with an external rating. This has a number of advantages for companies, banks and investors:

- Companies can issue smaller transaction volumes compared to public ABS transactions. This helps these originators to build up the necessary securitisation expertise and a corresponding track record, which facilitates the future issue of public transactions on the capital market as the company grows.

- If there is interest on the part of banks (as originators) and investors, private transactions can be topped up, and additional top-ups can be placed quickly if required. While public transactions are always arranged on a take-it-or-leave-it basis, private transactions enable financing to be adapted to the growth of the company.

Auto ABS

The securitisation of vehicle financing is mainly used by banks in Germany to create liquidity or for refinancing (sales financing). The transactions are usually arranged via traditional public ABS. As the sale of vehicles generally goes hand in hand with the provision of financing, specific market structures have developed.

In the case of captive automotive banks (captives), the focus is on procuring liquidity. This is usually done by placing the senior tranche. Non-captives also use auto ABS for risk diversification and capital relief.

Corporates

For securitisations in the corporate asset class (company loans), banks in Germany predominantly use synthetic balance sheet securitisations. This is because the underlying loan agreements often do not permit a true sale, and multi-country portfolios can be securitised more cost-effectively in a single transaction. Banks want to achieve capital relief, in particular by placing mezzanine tranches on the capital market. Synthetic securitisation and the associated capital relief thus offers banks an alternative to raising new capital.

Consumer loans

Banks in Germany primarily use securitisations in the consumer loan asset class to procure liquidity. Traditional public and private ABS securitisations are customary on the market. Liquidity is procured on the capital market, generally by placing senior tranches, or through retained transactions by the originator who then submits these to the ECB within the framework of repo agreements.

Mortgages

The securitisation of commercial mortgage-backed securities and residential mortgage-backed securities has a long tradition in the USA – where there is no financial equivalent to the German Pfandbrief. In Europe, too, property loans were increasingly financed via securitisation transactions until 2008. However, the financial market crisis and the resulting very extensive and costly regulation of a number of issuers have led to an increase in the use of covered bonds and a decline in the volume of mortgage-backed securities. This asset class is equally suitable for synthetic and true sale securitisations.